Traditional payroll practices, while fundamental to nearly every business with team members, have become outdated. Handing your payroll over to a bureau has long been the default option—simply because there hasn’t been a better alternative.

Migrating payroll solutions involves time and effort. That’s why selecting the right one can enhance team member trust and strengthen your relationship with your country’s tax institutions. It’s an opportunity to streamline processes and build confidence across the board.

Modern payroll management solutions can help you recover countless hours running payroll, avoid errors, and take the hassle out of compliance.

What is payroll management?

Payroll management handles team member compensation by calculating pay, accounting for deductions, ensuring timely payments, adhering to tax obligations, and managing payroll records.

HR teams use payroll management systems to maintain accurate records, establish payroll and compliance calendars, secure payroll data, and implement KPIs, ensuring proper management of the entire payroll process.

Why is effective payroll management important?

HR teams manage sensitive team member information, calculate taxes, transfer funds to bank accounts, and maintain updated documents—all requiring precision.

Failure to manage payroll effectively increases the risk of late payments or incorrect amounts. The right payroll management software can automate the process so you can reduce payroll errors, ensure timely payments, maintain compliance with regulations, and improve overall employee satisfaction.

What to look for in payroll management solutions

Every solution on the payroll landscape has strengths and drawbacks, so try identifying your most pressing pain points before making a decision.

Consider these questions when choosing a payroll management solution:

Does it manage compliance?

Most organizations prioritize confidence and peace of mind. Payroll errors cost time, money, and reputation. Look for a payroll management solution that will take care of compliance, reduce risk, and ensure team members get paid on time every time.

Is it easy to use?

Payroll may be essential and highly sensitive—but it’s not something most people want to spend a lot of time on. Most payroll management solutions are slow, error-prone, and rigid. Payroll teams often spend weeks processing payroll, exchanging multiple iterations of spreadsheets and PDFs, correcting errors, and racing against looming deadlines.

When choosing a payroll solution, consider its speed, ease of use, and flexibility so you can drastically reduce the time spent running payroll.

Do you need expert support?

Some solutions come with a lot more hand-holding than others. Support ranges from answering payroll queries from team members to navigating more complex payroll situations, keeping you up to date with legislation, and maintaining compliance. You may want to consider your personal payroll experience and the help you’ll need from your payroll provider.

Whatever your level of experience and expertise with payroll, you may require a solution that supports you, whether it can quickly answer questions about a team member’s pay or help you fix major compliance issues.

How big is your team? Are you expecting to scale?

If you expect your business to grow in the near future, this will cause more changes to your payroll. The more manual your payroll management process, the higher the risk of errors. If you’re a growing business, opt for a solution that can scale with your team.

How complex is your payroll?

The more variables and separate activities your payroll comprises, the more flexibility you’re going to require. Quickly note all the processes and components of your payroll: Gathering data, generating reports, creating and sharing payslips, payroll benefits, bonuses, and more.

When managing complex payroll, find a solution that automates some of these processes.

What software are you already using?

If your team uses an HRIS or accounting software, you might find yourself manually duplicating data between systems. To avoid this hassle, look for a payroll provider that integrates smoothly with your existing tools.

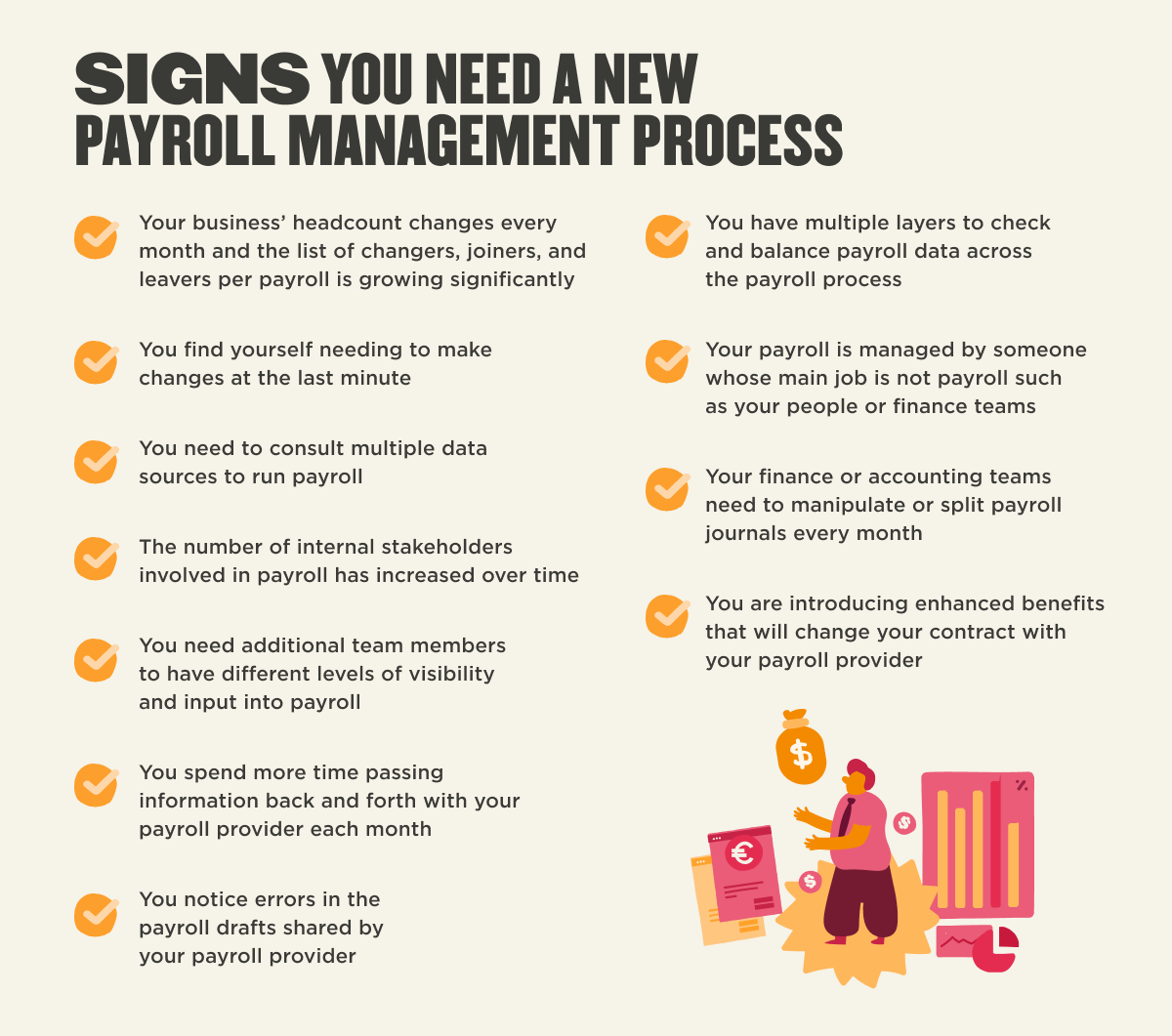

Signs you need a new payroll management process

Consider looking for a new payroll management system if:

1. Your payroll is too time consuming

Making accurate payments, distributing payslips, and posting journal entries use up valuable time. When you’re also responsible for keeping up with legislation changes, managing payroll manually can quickly become overwhelming.

2. You need expert support

Receiving expert support is one of the main reasons companies choose to outsource their payroll efforts, although the degree of support you receive will vary across providers. Determine if you need a level of expertise not currently on your team or are unhappy with the response times or quality of service from your current provider.

3. You’re lacking data and insights

To optimize your payroll, you’ll need access to high-level data. Ideally, you can track all salary changes, freelance fees outside of full-time payroll, bonuses, benefits, and compliance.

If you struggle to collect the data you need, consider a solution that comes with automatic reporting or work with an outsourced provider that will generate specific reports at your request.

Use this helpful checklist to determine whether or not you might need a new payroll solution.

Payroll management options

The best payroll management for a business depends on an organization’s size, administrative and operational requirements, and available resources.

Common payroll management options include:

- Manual payroll processing

- All-in-one systems

- Outsourcing to a bureau of accountant

- Outsourcing through managed payroll services

- Employer of Record (EORs)

- Legacy ERPs or systems

- Dedicated global payroll solutions

Manual payroll processing

Manual processing involves calculating pay, deducting taxes, and distributing paychecks using spreadsheets or basic accounting software. Many businesses, especially smaller ones, choose manual processing to save costs since it requires minimal technological investment and is quicker to implement.

Use cases

If you run a lean startup or manage a very small team (less than 20 people), you might prefer manual processing to maintain direct control and supervision over your entire payroll process.

What to consider

Payroll management requires meticulous record-keeping and strict compliance with regulations. Using a manual processing system to do this can be complex and time-consuming.

You can opt for this method at the beginning of your business to reduce software costs and directly supervise payroll. But, as your business grows or as tax laws evolve, the cons of this method might begin to outweigh its benefits.

While it saves software costs initially, the drawbacks—such as being error-prone, not scaling with your business, and requiring significant time to calculate pay and taxes—can eventually outweigh the benefits.

How much does it cost?

While manual processing doesn’t incur high startup costs, it demands a significant amount of time, increases the risk of errors, and can lead to costly fines or penalties.

All-in-one systems

All-in-one systems offer a seamless and powerful solution by integrating HR software and payroll management into a single platform. Unlike other payroll management options requiring separate payroll software, these comprehensive platforms include everything you need within your HR system.

An all-in-one system connects every aspect of your payroll and HR processes, providing a unified approach that saves time and minimizes errors. It can provide real-time updates and automate manual work, reducing the likelihood of errors, saving time, and ensuring timely payments.

You can use your all-in-one solution to manage multiple pay rates, navigate varying tax jurisdictions, and generate detailed reports for compliance purposes. You can also manage the rest of your HR needs, from recruitment and compensation to performance management.

Use cases

All-in-one systems support businesses with large, complex, and global workforces, as well as smaller businesses looking to scale. They work well for companies seeking to streamline operations, reduce administrative burdens, and ensure compliance across different regions and tax requirements.

What to consider

All-in-one systems empower your finance and HR teams to confidently manage payroll tasks without relying on a dedicated payroll specialist (although some payroll experience can still be beneficial).

All-in-one systems cover all essential HR and payroll functions and enhance your overall business efficiency, making it the ideal choice for reliable payroll processing.

How much does it cost?

All-in-one systems typically involve monthly subscription fees based on the number of team members or users.

Outsourcing payroll to a bureau or accountant

Outsourcing is when companies hand over payroll processes to a specialized payroll company. This company manages things like calculating wages, and tax deductions, generating payslips, and keeping compliant with the latest legislation—although you still have to send over information regularly.

Use cases

Certain industries, such as healthcare, finance, and government contracting, have stringent regulatory requirements related to team member compensation plans, benefits, and tax obligations. Outsourcing payroll to a provider experienced in handling compliance-heavy industries helps ensure adherence to industry-specific regulations, reducing the risk of errors and penalties.

Some companies have more complex payroll structures. You might, for example, have a mix of full-time team members, part-time employees, contractors, and freelancers. Outsourcing to payroll professionals can be a smart move, offering expertise and efficiency that help you stay compliant and simplify the payroll complexities of different employment types, varying pay rates, and statutory requirements.

What to consider

By outsourcing your payroll, you’ll be giving up a certain level of control over the payroll process. Once you send your data across, you’ll depend on your outsourcer to accurately process payroll and meet all tax deadlines. If any errors or delays occur, resolving them may require coordination and communication with the provider.

Outsourcing to a bureau or accountant can require you to work directly with a human and transfer data to them regularly. This could end up being manual to the point that they simply work out of your office or you send them physical paper documents.

How much does it cost?

The typical range for outsourcing payroll varies depending on the complexity of the payroll and the level of service required. Additional charges may apply to certain payroll-related services, such as year-end tax filing, handling team members’ benefits, or producing custom reports.

While outsourcing payroll will likely save you money in the short term, the cost structure of outsourcing often includes ongoing service fees, additional charges, or price increases over time could eventually outweigh the cost of bringing payroll in-house.

Managed payroll services

Managed services are similar to bureau or accountant outsourcing. The key difference involves providing a user interface to upload and download files. Just like your typical outsourced process, the payroll management provider will manage your payroll.

Use cases

If you’re not expecting huge changes in your payroll complexity or size, then outsourcing to a managed service provider might be for you. You won’t have to worry about making manual transfers, uploading pension files, or sending out payslips every month.

What to consider

Although managed services will give you an interface, the core functionality remains the same as outsourcing to a bureau or accountant. They work similarly to a shared Google Drive allowing you to upload your files.

How much does it cost?

Some managed payroll service providers charge a per-person fee. These fees typically cover basic payroll processing services, such as calculating wages, tax deductions, generating payslips, and ensuring compliance. However, additional services (year-end tax filings, pension administration, or producing custom reports) and one-off implementation can cost more.

Employer of record

An employer of record (EOR) takes on the responsibility of being the official employer for team members. An EOR will take care of payroll processing, benefits administration, and legislation, acting as an intermediary between you and your team members.

Use cases

EORs allow businesses to hire remote team members abroad without having a physical office in another country or needing to build a legal entity there.

If you have an internationally distributed team, an EOR may be the most logical option. They’ll handle the different tax systems, currency conversions, and country-specific payroll requirements.

If you have a somewhat distributed team, it may make more sense to use payroll software to pay the bulk of your team with the addition of an EOR to cover those abroad.

What to consider

Working with an EOR requires adherence to very tight deadlines. Payroll teams must confirm any pay changes early in the month since these changes may only take effect the following month.

While EORs look and sound like software, there will still be humans working in the background. Since they’re unlikely to have expertise in every country, they’ll often partner with bureaus in specific regions.

How much does it cost?

EOR services typically involve service fees, which will vary based on how many team members you have or the required level of support. Monthly service fees vary depending on the scale and complexity of your payroll.

Dedicated payroll solutions

Dedicated payroll tools automate calculations, payments, payslips, and journals in real time. These tools also manage payroll tasks like tax calculations, benefit deductions, and compliance tracking.

Use cases

Use dedicated payroll software if you’re a growing business that needs support automating your payroll processes. Since these point solutions only offer payroll, you’ll need additional software for your business management needs.

What to consider

While modern payroll software offers flexibility, it may not support global HR needs.

How much does it cost?

The average cost of payroll software for small to medium-sized businesses typically ranges from $4 to $8 per person per month. This usually includes core payroll functionalities such as calculating wages, managing tax deductions, generating payslips, and submitting payroll reports.

For larger organizations with more complex payroll requirements, the average cost can be higher.

Legacy enterprise resource planning (ERP)

Legacy enterprise resource planning (ERP) systems manage payroll through integrated modules that handle various payroll tasks. These systems typically rely on older, on-premises technology, and often require significant manual input and customization. You’ll work with dashboards, but a human still takes on administrative duties somewhere along the line.

Use cases

If you’re at a large organization with rigid workflows, legacy ERP software may be a good fit. These platforms should be able to fit with your existing software and processes—but they may not be as flexible as other payroll management solutions.

What to consider

ERPs generally don’t focus heavily on technology. While legacy platforms provide dashboards and some automation, they don’t differ much from traditional outsourcing. This means your overall experience feels much closer to that of managed services than a tech solution.

How much does it cost?

ERP solutions vary widely depending on your organization’s size and the specific features you require. This can range from more affordable options to higher-end solutions that require long-term contracts.

Best practices for managing payroll

Implement an airtight payroll strategy with these best practices.

1. Offer training for your payroll system

Offer your payroll teams consistent training to maintain uniform procedures and processes within their payroll system. Proper training helps team members adopt a unified method for processing payroll.

Every individual involved in the payroll process must understand the system thoroughly to ensure compliance and consistency in calculations and documentation. As your business evolves or payroll regulations shift, offer refresher courses to keep the payroll team updated and aligned with current standards.

2. Use an automated absence management system

Businesses using an automated absence management system monitor hourly team members effectively, eliminating issues like delayed payroll processing, time theft, and inaccurate timekeeping.

The system tracks work hours and absences in real time, storing this data in an accessible database. Automated time tracking ensures accurate payments, reflecting the exact hours worked by each team member.

3. Provide pay equity and transparency

Businesses must ensure that team members receive fair compensation for their work and effort. Communicate the metrics influencing pay, such as internal salary bands, market rates, and performance.

Building a transparent and equitable payroll system establishes trust between the organization and its team members. When team members understand that their pay reflects clear and objective criteria, they feel valued and appreciated.

4. Keep proper documentation

Payroll teams must maintain proper documentation to build an easily trackable and auditable payroll system. Keeping records of all paychecks, deductions, tax payments, and absentee rates ensures thorough tracking.

Organizations ensure compliance by maintaining all payroll tax records for at least four years (or as required by local regulations). This practice allows quick responses to any inquiries from legal authorities. Proper documentation within the organization enables tracking, analyzing payroll trends, and optimizing processes effectively.

5. Include global payroll

Businesses with teams across countries must manage payroll complexities effectively. Tracking work hours across multiple time zones, processing paychecks in various currencies, and complying with local laws requires careful coordination.

Implementing a global payroll system allows businesses to consolidate all payroll activities and information on a single platform. This approach ensures accurate and timely payments, regardless of team members’ locations.

6. Prioritize data security

Payroll teams must recognize and protect the sensitivity of all payroll records. Handling team members’ bank account information and tax details demands strict vigilance.

Businesses must implement robust data security measures, including password-protected systems, data encryption, and user access control, to safeguard this information.

Businesses outsourcing payroll management to a bureau or accountant must verify that external partners prioritize the safety of team members’ information.

7. Audit payroll management processes

About 25 percent of people report receiving incorrect paychecks, and many businesses discover these mistakes only through a payroll audit. Payroll teams conduct audits by thoroughly examining the payroll system, ensuring that:

- Proper documentation remains intact

- Data security measures protect sensitive information

- Payroll processes follow correct procedures

- All tax filings meet deadlines

- Compliance with regulations is consistently upheld

Regardless of the payroll management method, businesses can conduct internal payroll audits to identify inefficiencies in the payroll system and uncover skill gaps within the payroll team.

Benefits of integrating your HR and payroll management software

Deloitte’s study reveals that payroll integration with other systems ranks as a top need for many organizations, and for good reason. Managing payroll becomes inefficient and error-prone when businesses rely on multiple, disconnected platforms.

Integrating HR and payroll management software eliminates the disconnect between payroll and other HR activities.

- HR and payroll teams can access each other’s data, reducing the need for manual data entry in multiple systems.

- Team members can manage their personal data, pay, and tax information on one platform. They can also update banking details, submit timesheets, and view benefits seamlessly without needing HR support.

- Automation reduces the risk of compliance errors, protecting the business from fines or penalties.

- Consolidating HR and payroll data enables real-time reporting, giving leadership valuable insights into labor costs, trends, and financial forecasting, all from a single dashboard.

Support your people with the right payroll management system

Payroll management systems streamline your payroll system and enable you to automate manual processes like generating and disbursing payslips, tax calculations, recording team members’ data, and more.

With optimal payroll management, you can reduce errors, improve efficiency, save time, and stay compliant, so your HR team can focus on strategic initiatives and enhance the overall employee experience.

Payroll management FAQs

What is a payroll system?

Payroll teams use payroll systems to manage and automate payments to team members. These systems often integrate with HR platforms to collect information such as names, leave records, absences, and hours worked.

Businesses rely on payroll systems to maintain compliance, ensure accurate payments, and pay team members on time.

What is the difference between salary and payroll?

Salary refers to the fixed amount of money team members receive annually, typically paid monthly. Payroll is the process of calculating and disbursing these salaries while maintaining records of all paychecks.

Recommended For Further Reading

What is the role of HR and payroll?

HR teams focus on recruitment, onboarding, and managing team members’ performance. They manage records including personal information, performance evaluations, and contracts.

Payroll teams concentrate on financial compensation, ensuring timely and accurate payments, and filing all necessary tax forms.

Both HR and payroll teams intersect when handling records, collaborating on recruitment, determining salaries, managing benefit deductions, and processing terminations.

What are the phases of the payroll management process?

- Pre-payroll: This involves setting up tax adjustments, establishing payroll policies, and gathering data like hours worked, leave absences, and team member performance

- Payroll processing: Payroll teams calculate net pay for each team member based on the pre-payroll data, applying all necessary deductions

- Post-payroll: Payroll teams generate and send paychecks, record all transactions accurately, and ensure all taxes are correctly filed