When it comes to payroll management and paying your people in the UK, there are a few options to choose from: BACS and Faster Payments are two of the most popular ones.

Whether you’re at a large corporation navigating high-volume payments or a startup looking for flexibility and better cashflow, we’ll break down the key differences between the two systems—including their features, use cases, and benefits—so you can make an informed decision.

What are BACS payments?

BACS stands for Bankers Automated Clearing Services.

A BACS payment is simply a digital method banks use to move money between different bank accounts.

This system is used for all sorts of transactions, including payroll processing, direct debits, and creditor payments.

A regulatory body called Bacs Payment Schemes Limited—a regulatory body responsible for streamlining financial operations like payroll processing, direct debits, and creditor payments—oversees BACS.

What are Faster Payments?

As the name suggests, Faster Payments is a speedier alternative to BACS.

Faster Payments allow you to send money from one bank account to another in just a few seconds, whereas BACS payments take up to three working days.

When you use Faster Payments, you don’t have to wait for hours or days for the money to arrive. Once you initiate the transfer, the money generally appears in the other person’s account right away.

BACS vs Faster Payments: A quick overview

BACS payments and Faster Payments differ in speed, payment size, and transaction fees. The right payment method for your business depends on your organization’s needs.

BACS might be the right choice for companies that have restrictive day-to-day operations, like:

- Government agency

- Utility company

- Multi-national conglomerate

Faster Payments may be the better choice for modern companies who require more flexibility in sectors like:

- Banking and finance

- SMEs

- Online retailers

- Startups

- Services

Let’s review all the differences between BACS payments and Faster Payments so you can determine which is best for your payroll needs.

How do BACS work?

This is what the process of sending BACS payments looks like behind the scenes…

1. Apply for a BACS Service User Number

Apply for a six-digit BACS Service User Number (SUN) at your bank. The BACS payment database will use it to identify your business in future transactions. Your bank account manager can guide you through the application process.

2. Submit payment instructions

The process begins with an organization, typically an employer or a business, submitting a payment instruction file to their respective bank.

This file contains the details of the transactions you want to process, like the beneficiary’s information and amounts you need to send.

3. The bank aggregates and processes your transactions

Once the bank receives the payment instruction file, it bundles multiple transactions into batches.

The bank processes these batches, debits the payer’s account, and initiates the fund transfer.

4. The banks communicate with each other

The banks communicate with each other over the BACS system, which acts as an intermediary between the banks, to inform each other about the processed batches.

This stage involves checking if transactions are valid. It also involves making sure they follow regulations.

5. The beneficiary gets credited

Finally, the recipient’s bank receives the funds and credits their account.

How long does a BACS payment take?

BACS payments usually take three working days to process, as long as you send them before 10:30 pm.

Here are a few of the factors that will determine how long your BACS payment(s) will take:

Processing date

The day you place the payment instruction significantly affects the payment processing time. Payments processed on working days generally transfer faster.

Weekends and bank holidays

Banks don’t process BACS payments on weekends or bank holidays.

Batch processing

Batching multiple transactions together can improve overall efficiency, but grouping them can lead to delays.

Bank-specific processes

Individual banks might have specific internal processes that influence the exact timing of a BACS payment. Variations between banks can lead to minor discrepancies in payment timelines.

BACS cut-off times

According to the BACS website, businesses must submit payment files between 7:00 am and 10:30 pm on business days.

If you send BACS payments before the cut-off time, they typically take three working days to clear. For example, if you send a payment on Friday before the cut-off time, you can expect it to arrive by Tuesday.

BACS payments enter accounts between 1:00 am–7:00 am. If the bank hasn’t credited an account by 7:00 am, the payment will arrive the next working day.

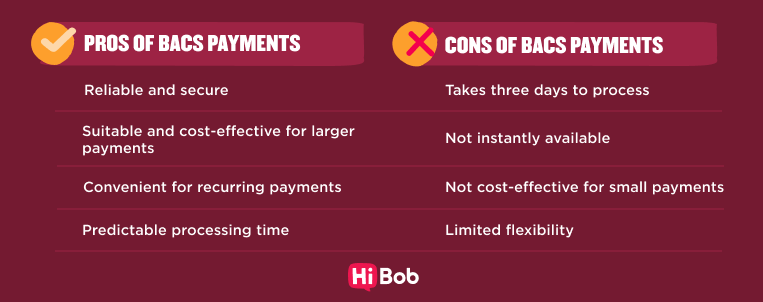

Pros and cons of BACS payments

Benefits of using BACS payments

Let’s look at why people choose BACS payments:

Reliability and security

BACS payment services are known for being reliable and secure

The system’s automation reduces the likelihood of errors, and robust encryption protocols safeguard sensitive financial information.

Cost-effective for larger payments

BACS transactions are generally more cost-effective, especially for larger transfers. Bulk processing and batching transactions can help reduce operational costs.

Suitable for large payments

BACS payments work well for larger transactions where immediate access to funds isn’t a major concern. Having funds immediate availability is not critical.

Predictable processing time

BACS transactions have a predictable transfer time (typically three business days). This predictability helps manage cashflow.

Limitations of BACS payments

While BACS payments offer cost-effective solutions, they also have some drawbacks:

3-day processing time

BACS payments’ three-day processing time can cause headaches for transactions that require immediate fund transfers, especially in time-sensitive situations.

Lack of instant availability

The rigid processing time of BACS transfers means that recipients can’t immediately access their funds.

Not cost-effective for small payments

BACS payments between banks in the UK can cost between 5 and 50 pence per transaction—plus additional charges by your bank.

Limited flexibility

Banks only process BACS payments on working days, not weekends or bank holidays. This schedule can limit businesses that need to make transactions outside of regular business hours.

Plus, every year BACS releases its own calendar that businesses must follow to make payments. This reduces flexibility and adds administrative burden when making payments.

Not ideal for real-time financial management

If your business requires up-to-the-minute financial management or immediate updates on account balances, the slower BACS processing time can prevent you from getting a real-time overview.

How do Faster Payments work?

Here’s how Faster Payments typically work (when used for payroll):

1. Prepare your data

To kick off the process, you’ll need to prepare your payroll data (salaries, tax deductions, benefits, etc).

2. Calculate and approve payments

Next, calculate the net pay for each team member after taxes, deductions, and other factors. You can use dedicated global payroll software to handle this process. Then, review and approve the calculations.

3. Initiate the payment

Initiate the Faster Payments transfer using a banking portal or payroll software. Upload a file containing employee payment details, including bank account numbers, sort codes, and corresponding amounts.

4. Your bank verifies the transfer

Your bank verifies the availability of funds in your account and checks for any security or fraud concerns.

Once the bank completes the verification, it will authorize the payment.

5. Payments are processed and credited

A Faster Payments system processes your payment instructions and sends the funds to each team member’s bank account in near real time.

6. Your people are notified

A Faster Payments system notifies your team members via email or text message confirming the receipt of their salaries.

7. Payment records

Keep records of all your payments, including the transactions’ details and confirmation receipts. These records help with financial reporting, tax purposes, and auditing.

How long do Faster Payments take?

Most Faster Payments arrive within minutes, though some may take up to two hours. That being said, Faster Payment systems will always credit recipients by the end of the next business day.

These are some factors that may impact how long your Faster Payment takes to arrive:

The banks

You and your employees’ banks may have different processing speeds and efficiency levels. Some banks might have more streamlined systems, which means quicker transfers.

Network traffic

Faster Payments systems slow down when handling a large volume of transactions. To ensure quick processing, send your payment during off-peak hours.

Faster Payments cut-off times

Banks set cut-off times for processing Faster Payments. If you initiate a transfer after this cut-off, the payment might queue for the next processing window, potentially causing a delay in delivering a payment (sometimes as late as 5:30 pm).

Technical issues

Occasionally, technical glitches or issues in the payment network or banks’ systems might cause delays, although this is fairly rare.

Pros and cons of Faster Payments

Benefits of using Faster Payments

Faster Payments systems offer many benefits that can enhance your financial transactions and business operations.

Speed and efficiency

Faster Payments enable near-instantaneous fund transfers between accounts. This makes it easy to make urgent payments, such as payroll, supplier payments, or time-sensitive transactions.

24/7 availability

The Faster Payments system is usually available 24/7 (including weekends and bank holidays).

This gives you more flexibility to initiate payments at your own convenience, without being constrained by banking hours.

Improved cashflow

The Faster Payment method helps businesses improve cashflow and ensures recipients can access funds quickly.

This can be especially helpful if you’re an SME that needs readily available funds.

Reduced admin

Using Faster Payments can help reduce your manual administrative work. It automates processes like sending payment instructions and helps with account reconciliation, compliance management, and reporting.

Employee satisfaction

You can use Faster Payments to ensure team members receive their salaries on time. People can plan their finances, pay bills, and enjoy peace of mind. This reliability enhances morale, satisfaction, and trust.

Real-time notifications

Faster Payments sends real-time notifications to senders and recipients so you can keep track of your transactions and know if they went through.

Emergency payments

If you ever encounter an emergency or unexpected situation, you can use Faster Payments to quickly transfer funds.

Limitations of Faster Payments

Faster Payments might be a good fit for your organization, but it’s important to be aware of certain limitations:

Transaction limits

Some Faster Payments systems may have transaction limits, which will restrict the amount you can transfer in a single transaction.

This limitation might not be suitable for large-value payments or bulk transactions, usually when amounting to more than £1M per transaction.

Transactions are irreversible

Once you process Faster Payments, you can’t reverse them. This makes it hard to recover funds if an error or fraudulent transaction occurs.

Limited international reach

Faster Payments systems cater to domestic bank payments within the UK. If you need to send payments abroad, you can use SWIFT or international wire transfers.

Recipient bank participation

Faster Payments require both your bank and your recipient’s bank to participate in the system. The payment might be delayed if your recipient’s bank isn’t in the Faster Payments network.

You must integrate your systems with Faster Payments’ platforms to use them. This process can be complex and time-consuming.

Faster Payments costs

While Faster Payments can be cost-effective for many transactions, there may still be associated fees. For bulk transfers, BACS transfers might be cheaper.

Lack of payment details

Faster Payments may not provide detailed payment information. This can cause issues if you need to include specific payment references or invoice details with transactions.

Integration challenges

You’ll need to integrate your systems with other banks’ platforms to initiate Faster Payments.

This integration process can sometimes be complex and time-consuming.

BACS payments vs Faster Payments: Complete overview

Let’s summarize the key differences between BACS and Faster Payments so you can choose the right fit for your business.

Speed

Faster Payments systems complete transactions in seconds or minutes. BACS payments can take up to three working days.

You can choose between the two based on your organization’s payroll processing method and what you feel is best. For example, if you pay your people weekly or bi-weekly and need fast payments, Faster Payments might be best. If you pay monthly and prefer lower costs, it may make more sense to go with BACS.

Cost

BACS are generally cheaper than Faster Payments. They offer lower transaction fees (or none), especially when sending payments in bulk.

In the UK, BACS payments cost between five and 50 pence, depending on the amount and volume of the transaction. Your bank may also charge additional fees. For example, Barclays charges 0.35 euros for three working day payments.

Depending on the transaction amount, Faster Payments charges between 0.45 pounds and 2.50 pounds per payment.

Making changes

BACS payments offer a three-day processing window so you can cancel or modify payments before funds settle.

You can’t reverse Faster Payments because they’re pretty much instant.

Transaction size

BACS handles higher-value transactions. Faster Payments handle low- to medium-value transactions. BACS’s ability to process transactions in bulk makes it ideal for bulk corporate payments and salary transfers.

You can use Faster Payments for smaller and more frequent transactions.

Availability

You can send Faster Payments any time, including weekends and holidays. BACS only operates during banking hours on business days.

BACS’s limited availability makes it unsuitable for time-sensitive payments. You must schedule and plan payments to ensure they drop when you want them.

Are Faster Payments safe? Are they riskier than BACS?

Financial authorities regulate and monitor Faster Payments and BACS. If safety is your top priority, the security of the two systems is similar.

That being said, BACS payments can provide more security due to the longer processing time. Faster Payments’ quicker processing times can introduce certain risks around fraud detection and customer awareness.

Strong security measures and monitoring can mitigate these risks. Faster Payments systems offer:

- Encryption: Faster Payments encrypt transactions and secure the data transmitted between banks to ensure confidentiality and prevent interception

- Authentication: Banks employ strong authentication methods to verify the identity of users initiating transactions

- Fraud detection: Banks and financial institutions use advanced fraud detection mechanisms to identify and flag suspicious or unauthorized transactions

- Industry standards and regulations: Financial authorities and government bodies regulate the Faster Payments system to ensure compliance with security and privacy standards

- Bank guarantees: Banks often reimburse customers for unauthorized transactions or fraudulent activities

No matter which payment system you choose, stay vigilant against scams like app fraud and CEO fraud. Take additional steps to protect yourself, like using strong passwords, implementing multi-factor authentication, and avoiding suspicious links.

The BACS vs Faster Payments verdict: It depends on your organization’s payroll

Ultimately, whether you opt for BACS or Faster Payments depends on your specific preferences. There is no objective right answer.

BACS is broadly known for being trusty but often requires batch processing and manual intervention. Faster Payments emphasize automation and real-time processing.

It really just depends on where your priorities lie:

BACS: Better for reliability, cost-effectiveness, and handling recurring payments.

Faster Payments: Better for real-time transfers, immediate availability of funds, and flexibility.

Meet Bob

Bob simplifies payroll for your UK teams with an all-in-one HR and payroll software. Streamline end-to-end payroll for your UK workforce by:

- Centralizing payroll data: Remove the need for duplication by maintaining Bob as the source of truth for your people and payroll data and operations

- Processing payroll in minutes: Cut down on time and automate the end-to-end payroll process without payroll windows or deadlines, including salary payments via BACS or Faster Payments and tax payments to HMRC

- Delight employees with an all-in-one HR and payroll experience: From onboarding to day-to-day payroll needs, employees can access all their HR and payroll documents in one platform

- Customizing payroll: Manage diverse payroll needs, including different pay schedules, IR-35 contractors, and flexible employees with varied rates

- Automating payroll calculations: Automate your complex payroll calculations like taxes, deductions, and benefits

- Accessing expert support: Work with our CIPP-certified payroll professionals to ensure you’re running payroll efficiently and accurately

- Managing tax and compliance: Manage tax withholdings, contributions, and reporting, so your businesses will always stay compliant with the latest HMRC laws and regulations

But, that’s not all. Bob’s complete modern HR platform also provides features for:

- Core HR: Leverage this as a foundational hub, offering a social-media-like interface to enhance team engagement.

- People Analytics: Track metrics such as employee turnover and growth rates, aiding in proactive management and cultural alignment.

- Automated onboarding: Use HiBob’s automated onboarding process to ensure a smooth integration of new joiners and align them with the company’s culture from the start

- Time and attendance: Manage time tracking and attendance efficiently, simplifying payroll processes and ensuring accuracy

- Performance Management: Conduct 360-degree reviews and effectively align team member goals with organizational objectives

- Workforce Planning: Use data-driven tools to forecast hiring needs and plan resource allocation strategically

- Surveys: Engage team members through surveys, gathering valuable feedback that informs improvements and measures satisfaction, helping to foster a responsive and inclusive culture

From out-of-the-box onboarding, workflows, performance management, and payroll for UK teams, Bob’s breadth of core HR functionally gives your team everything needed to operate efficiently.

BACS vs Faster Payments FAQ

More information on BACS and Faster Payments:

What is a BACS Service User Number?

A BACS Service User Number is a unique six-digit number assigned to a service user or organization so they can take payments via direct debit.

Is BACS the same as a bank transfer?

Although people often use the terms interchangeably, BACS differs from a bank transfer. BACS is a type of bank transfer, along with Faster Payments and CHAPS.

Which is faster, BACS or Faster Payments?

Faster Payments are significantly quicker and take just a few seconds to process. BACS may take several working days to process.

Do Faster Payments work on weekends? Do Faster Payments work on bank holidays?

Yes, Faster Payments work on weekends and during holidays, not only during business hours when banks open.

When are BACS payments typically used?

BACS payments are commonly used for non-urgent payments and bulk payments.

When should I use Faster Payments?

Use Faster Payments when you want to make time-sensitive payments like urgent salaries, supplier payments, or immediate transactions.

Are there differences in transaction fees?

BACS offers low or no fees. Faster Payments can charge for its speed and convenience.

Recommended For Further Reading

What are CHAPS payments?

CHAPS stands for Clearing House Automated Payment System. According to Starling Bank, CHAPS payments are a type of bank transfer similar to Faster Payments.

CHAPS offers same-day payments, which are ideal for time-sensitive lower-value payments or bulk high-value payments above Faster Payments’ transaction limit.

You can make CHAPS payments from 6 am–6 pm, Monday through Friday, excluding public and bank holidays.

What are SWIFT payments?

SWIFT stands for Society for Worldwide Interbank Financial Telecommunication. It’s an international electronic transfer payment that allows people to send or receive money through intermediary banks.

According to Wise, SWIFT payments are processed within 2-5 working days, and people can send or receive money in different currencies.