Need help getting your head around the weekly payroll?

While your team can benefit from weekly payments, you’ll also face unique challenges.

We’ll explain everything you need to know about weekly payroll—how it works, use cases, and the steps you need to run the process smoothly.

Weekly payroll explained

As its name suggests, weekly payroll refers to the process of paying team members on a weekly basis, typically every seven days.

This payroll frequency is common for businesses that have a workforce with varying hours and shifts for different employee types, like part-time or hourly team members.

Running weekly payroll means team members receive their wages more frequently than other payroll schedules.

You simply calculate and process pay for your team members based on their salary or the hours they’ve worked.

These calculations will include regular hours, overtime, bonuses, and more.

Weekly payroll can provide team members with a sense of financial stability since they receive more payslips. However, due to the more frequent processing and reporting requirements, it can also come with its own administrative challenges.

Advantages of weekly payroll

Weekly payroll will benefit your organization and your team members. Here’s how:

Weekly payroll benefits for your people

Weekly payroll provides:

Frequent and consistent payment

Research shows that about 34 percent of people prefer weekly payments because it helps them budget better. With monthly paychecks, individuals may deplete their funds by the last week of the month and struggle to meet financial obligations.

Weekly payroll can give your team members more control over their finances and help them plan for their expenses week to week. It ensures they receive pay consistent with the number of hours they work each week. This allows them to manage their money better, plan for the future, and cover any weekly recurring expenses.

Flexibility

Any part-time or temporary team members who work irregular schedules can benefit from weekly payments since their compensation aligns with their working hours.

Additionally, it simplifies overtime tracking and payment. You can calculate and pay overtime more accurately and promptly when team members work extra hours.

This immediate compensation for extra work can boost employee satisfaction and motivation. It also helps you manage labor costs more effectively by providing a clearer, week-by-week picture of overtime expenses.

Weekly payroll benefits for employers

Organizations can also benefit from maintaining a weekly payroll process. Weekly payroll offers:

Improved accuracy and transparency

Using weekly instead of monthly pay periods generally means you can be more accurate and transparent when tracking hours worked, wages earned, and deductions made.

More frequent calculations should reduce the likelihood of any errors or discrepancies.

Easier overtime and bonus calculations

If you’re in an industry with varying work hours—like retail or hospitality—a weekly pay frequency will help simplify the calculations you need to make for overtime, bonuses, and shift differentials.

Real-time insights

Weekly pay periods will allow you to view your labor costs in real time, enabling you to make informed decisions regarding staffing and resource allocation.

This is particularly useful if you have seasonal or temporary staff.

Simpler record-keeping

With weekly pay, records of hours worked, wages earned, and deductions made will be much easier to keep up to date since you’ll make a more manageable volume of changes each time.

You’ll also eliminate the issue of salary prorating for team members or new people who start work during the month. The team member will get paid for the hours worked during the week, removing the need for you to prorate pay.

Happier team members

You’ll build a more positive work culture by supporting your team members and giving them everything they need to work better, including paying them weekly.

When you pay your people weekly, you put them in a better financial position. This can make your team members happier, which improves their engagement, retention, and overall productivity.

Challenges of using a weekly payroll system

While weekly payroll offers many benefits to you and your people, implementing it might present certain challenges.

Common issues you may face include:

- More work for business owners: Increased admin work due to more frequent calculations and payments

- Extra cost: Potentially higher processing costs compared to less frequent pay schedules

- Higher risk of errors: With an increased frequency of calculations comes an increased risk of human error

How to run weekly payroll

Here’s how you can take charge and run your weekly payroll like a professional:

1. Collect team member records

Gather all the necessary information for each of your team members—their personal information, tax codes, hourly rates, etc.

Double-check that you have up-to-date details to avoid any errors.

2. Calculate pay

You can do this differently depending on your team members’ contracts or hours.

Based on hourly rate (for hourly team members)

For hourly paid team members, track their hours worked each week, including regular hours and any overtime.

Ensure you account for any variations in working hours, such as shifts or additional hours worked.

To calculate gross wages, just multiply the hours worked by the respective hourly rates for each team member.

Include any additional payments, such as overtime or bonuses. This will give you the gross wages for the week.

Convert annual salary (for salaried team members)

To calculate the weekly pay for team members on regular salaries, you’ll need to take their annual wage and divide it by the number of weeks in a year (52).

So, if a salaried team member earns $50,000 per year, their weekly wage would be around $961.53.

3. Calculate deductions

Next, calculate deductions for income tax, retirement contributions, and any other mandatory or voluntary deductions.

Just make sure to use the correct tax codes and contribution rates.

4. Work out the net pay

Subtract the deductions from the gross wages to calculate each team member’s net pay.

5. Generate payslips

You’ll need to create detailed payslips for each of your team members. Payslips should include information about gross and net pay, deductions, and any additional payments.

6. Review and double-check your data

Before completing your global payroll process, review all your calculations, deductions, and payslips to double-check they’re accurate and error-free.

7. Pay your team members

Transfer the net pay to your team members’ bank accounts.

You can do this through bank transfers or direct deposit, depending on your preferred payment method.

8. Address any team member queries

More frequent payroll cycles mean more team member queries. Be prepared to address any queries your team members might have regarding their wages, deductions, or tax codes.

A few bonus tips if you’re paying team members weekly

By investing in the right tools and staying on top of your process, you can streamline your process, reduce errors, and ensure that your team members are always paid accurately and on time, whether they get paid on a weekly or monthly basis.

Choose a reliable payroll software provider: Spending too much time on payroll? It’s worth investing in a reputable payroll system that can automate calculations, generate payslips, and centralize payroll information in one payroll hub.

Establish clear payroll policies: Clearly define your payroll policies and make sure all team members are aware of them. This includes guidelines on overtime, bonuses, deductions, and payment schedules.

Consistent timekeeping: Implement a reliable timekeeping system to accurately track things like weekly hours as well as irregular overtime.

Stay up to date with any legislation changes: Regularly check for updates to tax codes, contribution rates, and any other relevant payroll regulations.

Monthly payroll vs weekly payroll

You determine whether to run payroll weekly or monthly based on your specific industry and working patterns.

Account for things like team member expectations, industry norms, cash flow management, and admin capacity when deciding which payroll schedule is most appropriate for you.

Some businesses opt for a hybrid approach, using monthly payroll for salaried team members and weekly payroll for hourly or part-time staff.

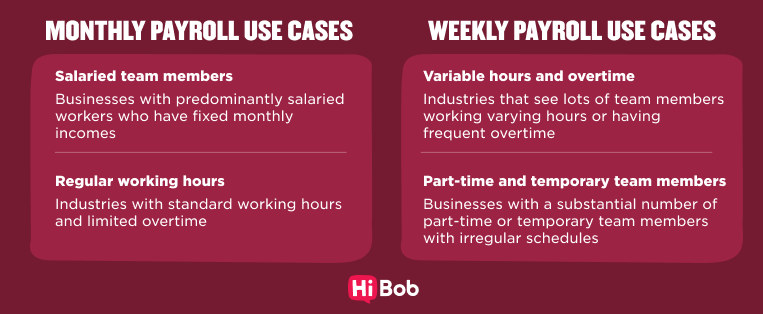

Monthly payroll use cases

You can maintain a monthly payroll if you have:

Salaried workers: Businesses with predominantly salaried workers with fixed monthly incomes usually use monthly payroll. These team members expect a consistent pay schedule.

Regular working hours: If you’re in an industry with fairly standard working hours and limited overtime, you’ll likely find monthly payroll simpler to manage since there are fewer variations in your pay calculations.

Weekly payroll use cases

You can maintain a weekly payroll if you have:

Variable hours and overtime: If your industry tends to see team members working varying hours or having frequent overtime (retail, hospitality, manufacturing etc.), chances are, you’d benefit from weekly payroll since you can calculate variable pay and overtime easily.

Part-time and temporary team members: If your workforce includes a substantial number of part-time or temporary employees with irregular schedules, weekly payroll can align better with their payment needs.

Choose a modern payroll solution that supports all industries and working patterns

Moving to a weekly payroll structure will help you plan payroll better and keep your team members happier as a bonus. But this change can add admin work, raise your payroll processing costs, and increase the chances of errors.

To make the transition from monthly or bimonthly to weekly payroll smoother, use payroll software. The right payroll software will provide you with a centralized dashboard where you can easily track your team members’ hours and efficiently maintain a flexible payroll cycle.

Meet Bob

Bob simplifies payroll for your UK teams with all-in-one HR and payroll software. Streamline end-to-end payroll for your UK workforce by:

- Centralizing payroll data: Remove the need for duplication by maintaining Bob as the source of truth for your people and payroll data and operations

- Processing payroll in minutes: Cut down on time and automate the end-to-end payroll process without payroll windows or deadlines, including salary payments via BACS or Faster Payments

- Delight team members with an all-in-one HR and payroll experience: From onboarding to day-to-day payroll needs, team members can access all their HR and payroll documents in one platform

- Customizing payroll: Manage diverse payroll needs, including different pay schedules, IR-35 contractors, and flexible team members with varied rates

- Automating payroll calculations: Automate your complex payroll calculations like taxes, deductions, and benefits

- Accessing expert support: Work with our CIPP-certified payroll professionals to ensure you’re running payroll efficiently and accurately

- Managing tax and compliance: Manage tax withholdings, contributions, and reporting, so your businesses will always stay compliant with the latest laws and regulations

Weekly payroll FAQ

Learn more about weekly payroll:

How many payroll weeks in a year?

There are 52 payroll weeks in a year. Since there are 52 weeks a year, one week equals one payroll period.

But please note that some years may have 53 weeks, depending on when your payday falls. This can happen when the year starts or ends on a Friday or Saturday, causing an extra payroll period.

Recommended For Further Reading

How does weekly payroll differ from other pay frequencies?

Weekly payroll is more frequent than bi-weekly or monthly pay schedules.

This means that your team members receive their pay every week, resulting in more frequent but smaller payslips.

How do I handle holiday pay and other statutory payments?

In the UK, you have to make sure your team members get holiday pay and other statutory payments like sick pay and maternity pay.

You calculate these payments based on their average weekly earnings over a specific period.

You can look at a team member’s pay over the last 52 reference weeks they’ve worked, counting back up to 104 weeks to get to 52 weeks total. If they didn’t work at all or had statutory payments in one of the potential reference weeks, you’d simply exclude this week in your calculations.

Note: If a team member hasn’t worked with you long enough to get to 52 reference weeks yet, you can still use the 52-week method. Just use the actual number of reference weeks they’ve worked so far to calculate your average.