Payroll is one of the most time-consuming tasks for HR and payroll teams. Payroll automation helps streamline global payroll calculations, tax compliance, and team payments.

So whether you’re shopping around for a new payroll management tool, looking to learn how payroll automation works, or making a business case for switching providers, this article will explain how and when to migrate and some of the types of payroll automation software available.

What is payroll automation?

HR and payroll teams use payroll automation to streamline tasks like calculating compensation, generating reports, and ensuring team members receive their salaries. This system reduces manual effort and minimizes errors.

If you don’t automate your payroll, you’ll have to:

- Manage payroll manually in-house: Small businesses can manage payroll manually using spreadsheets. This method works with a few team members but increases the risk of errors and administrative burdens as businesses scale.

- Outsource payroll: Business owners may hire accountants to manage payroll. This approach can benefit businesses with limited resources and staff, though you’ll still need to do some manual work, like sending documentation and checking entries.

Key takeaways

- Payroll automation streamlines payroll processes by handling salary calculations, tax compliance, and employee payments, reducing manual effort and errors.

- Businesses can save time and money by automating payroll, minimizing administrative burdens, and reducing compliance risks.

- Key features of payroll automation software include automated tax filing, payroll reporting, employee data management, and seamless integrations with HR and accounting systems.

- Companies can choose from different payroll solutions, such as ERP systems, all-in-one HR platforms, or dedicated payroll software, depending on complexity and scalability needs.

- A smooth payroll automation transition involves auditing current processes, selecting the right provider, preparing data, testing the system, and ensuring compliance.

- The best time to switch to payroll automation is before tax season, during quieter business periods, or when compliance regulations change.

- Automating payroll enhances accuracy, compliance, efficiency, and scalability, positioning businesses for long-term success.

Benefits of payroll automation: Making the business case

Businesses can use payroll automation to:

Reduce payroll errors

Tired of wasting time double-checking for manual errors? Automate payroll calculations and tax deductions to eliminate the risk of error and save yourself rounds of checks.

Spend less time running payroll

Automating laborious payroll tasks can reduce the amount of time you need to spend each pay cycle. Using automated payroll software to handle manual tasks like data entry and calculation to free up time to spend on more impactful, strategic work.

Simplify tax filing

Payroll automation can simplify tax filing by ensuring precise and standardized tax calculations focusing on current laws and regulations. This can reduce errors that could lead to penalties.

Build a scalable process

Automate payroll to create scalable processes for your growing business. These systems can accommodate additional team members as the company grows, simplifying onboarding and managing payroll complexities.

Save money

Switching to an automated payroll solution will usually save money in the long term. If you can reduce administrative overheads, spend less time on manual payroll tasks, and avoid paying for payroll outsourcing, you can cut costs and allocate resources efficiently.

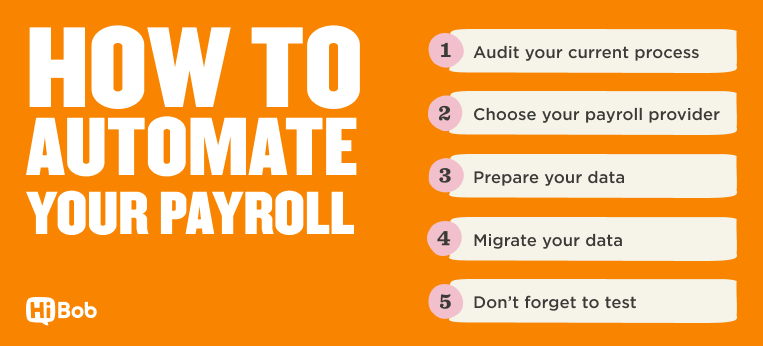

How to automate your payroll processes

You can automate payroll with these steps:

Step 1: Audit your current processes

Consider the most pressing pain points in your current payroll process and what you want to solve.

Ask yourself:

- Is compliance a priority?

- Do you need to save time?

- Does payroll eat up too much of your day?

- Do you need more data or insights?

- Do last-minute changes become a hassle?

- Are you planning to introduce new benefits?

- Do you frequently double-check for errors?

You can also identify pain points by:

- Sending out surveys to gather feedback from employees

- Conducting an internal audit to assess current HR processes and spot inefficiencies

- Consulting with payroll teams to understand their challenges

- Having one-on-one discussions with individual team members to get their perspectives

You can use these questions to understand the issues and find a lasting solution.

Step 2: Choose your payroll provider

The best software depends on your specific needs (we’ll cover the various types of solutions further down).

Be warned: not all payroll software providers will offer the same level of support and flexibility.

Focus on choosing the right payroll provider by:

- Looking at your expertise: Consider your internal payroll, HR, and finance teams and how much support you might need.

- Considering growth: Anticipate growth and look for scalable solutions to minimize additional administrative work even with more starters and leavers

- Assessing payroll complexity: Take stock of retirement plans, payroll benefits, bonuses, and working patterns

- Reviewing tech integration: See if the payroll provider integrates with your current tech stack, like your HR software and accounting platform

- Evaluating ease of use: Look for user-friendly solutions that simplify payroll processes and reduce the learning curve

- Analyzing cost: Compare costs and ensure the provider fits within the organization’s budget while still offering essential features like payroll reporting and calculations

Step 3: Get your data ready

Next, prepare for data migration by:

- Gathering data: Collect necessary information, including team member details, salary records, tax codes, and historical payroll data

- Cleaning and validating the data: Clean and validate the data to ensure accuracy. Check data formats for consistency, such as birth and calendar dates, often written in different formats.

- Preparing for transfer: Organize the data for a smooth transfer to the new payroll software. This involves formatting the data according to the new system’s requirements, ensuring all fields are complete, and creating backups of the original data.

Step 4: Migrate your data to the new system

Work with your new software provider to migrate your data from your old system to the new one. Depending on the provider, this might require manual data entry.

You’ll want to:

- Migrate your data: Transfer data from the old system to the new one. Use migration tools, import data files, or manually enter information if necessary. Ensure all data is correctly formatted for the new system.

- Then verify accuracy: Cross-check records, run sample payrolls, and compare the imported data to the original data to confirm accuracy. Create a checklist to ensure all data points have been accurately transferred.

Step 5: Don’t forget to test

Before you can start using a new automated system, you can perform thorough testing to ensure calculations, deductions, and other payroll processes are accurate and compliant.

Test the new automated system by:

- Performing thorough testing: Conduct comprehensive tests to ensure calculations, deductions, and other payroll processes remain accurate and compliant. Test different scenarios such as bonuses, overtime, and tax changes to verify all aspects of the system.

- Requesting a parallel run: You can also ask the provider to perform a parallel run to confirm that the system pulls the correct data

What features does a payroll automation tool usually have?

Teams use payroll automation tools for:

Employee data management

Capture and store team member information like name, address, bank details, pensions, and salary.

Payroll calculations

You can automate calculations for compensation, tax deductions, National Insurance contributions in the United Kingdom, and social security contributions in the United States.

Built-in compliance

Switching to an automated solution will help you keep up with legislative changes and manage end-of-tax year responsibilities. In the UK, you can finish EPS and FPS reporting in-house with a click and know you have completed your compliance tasks. Most platforms can let you auto-update employee tax codes and student loans.

Payroll journal reporting

Customize payroll journals or automatically report to their preferred accounting software, maintaining familiar layouts.

Automated payments to employees

Ensure timely payments to all team members every payday and schedule tax authority payments to optimize cash flow.

Integrations

Integrate payroll systems with existing HR software or accounting systems to avoid data duplication and streamline onboarding.

Payroll reporting

Moving to an automated platform will allow you to generate a variety of payroll reports for team members and compliance reporting.

Types of payroll automation software

HR and payroll teams can use a range of payroll automation software. They include:

1. Legacy Enterprise Resource Planning (ERP)

ERP systems support payroll by s consolidating employee information, performing automated calculations for wages and deductions, and ensuring compliance with payroll regulations. They also generate comprehensive payroll reports and integrate payroll data with other business functions such as HR and finance.

However, ERPs still require human intervention for functions like HR and finance. For example, you can use ERP software to handle data uploads and generate reports, but you still have to update employee records and manage benefits manually.

This setup makes ERPs feel more like traditional outsourced services than modern tech solutions. Despite this, ERPs offer more convenience than fully manual operations because they automate many repetitive tasks, reducing the overall workload.

2. All-in-one systems

All-in-one payroll automation systems integrate payroll, benefits, time tracking, and other HR functions into a single platform.

Businesses may find these solutions more advanced and user-friendly than ERPs. They reduce manual data entry, minimize errors, and update information across all HR functions, ensuring accuracy and compliance.

All-in-one systems offer a user-friendly interface, making managing payroll and related tasks easier. These systems come with built-in support and regular updates, keeping the software current with the latest regulations and technological advancements.

All-in-one payroll systems provide long-term benefits, including time savings, reduced administrative burden, and enhanced data accuracy. These advantages make them a valuable asset for businesses seeking to optimize their HR operations.

Some all-in-one platforms also provide access to human support from CIPP-accredited payroll specialists, offering expert assistance when necessary.

3. Payroll software

Modern payroll software automates manual payroll tasks, freeing up time and resources for strategic initiatives. This software offers features like real-time data processing, automated tax calculations, and compliance management.

How to know which payroll automation solution is best for you

When choosing a payroll management solution, start by defining what problems you’re looking to solve.

How big is your team? Are you expecting it to change over time?

Start by evaluating the size of your teams and anticipating future personnel changes. Look for a solution that scales with the business as payroll complexity increases.

Small- to medium-sized organizations can use most payroll software tools. However, organizations with headcounts of 500–1,000 or more may require solutions designed to manage high levels of complexity.

How complex is your payroll already? Do you need to support different teams?

You’ll want to break down your variables and moving parts. If you have a complex payroll, you may need a solution that is flexible enough to support you.

- Benefits complexity: Evaluate your team’s benefits. Consider health insurance, retirement plans, bonuses, and other perks. If you offer multiple health insurance plans or complex retirement options, choose a payroll system that handles these tasks efficiently. This ensures the system manages and automates benefits, reducing manual effort and errors.

- Compliance requirements: Review your compliance needs. Different regions and industries have specific regulations for payroll, taxes, and employee benefits. Choose a payroll system that supports compliance with these regulations to avoid legal issues. If new legislation affects payroll taxes or your people’s rights, use a compliant system to stay updated and adhere to these changes seamlessly.

- Payroll frequency: Determine how often you run payroll, weekly, bi-weekly, or on-demand. Select a payroll system that accommodates your preferred schedule and provides flexibility for changes. This ensures you pay your employees accurately and on time.

- Global team support: Manage payroll for a global team by considering different currencies, regulations, and time zones. Choose a payroll system that can handle international payroll efficiently and compliantly. Ensure your system supports a centralized approach to reduce inefficiencies and maintain accurate, timely payments.

How much support are you likely to need?

An automated solution will do most of the heavy lifting and reduce repetitive tasks, but you may require outside help for specific issues.

If you already have a fair amount of payroll experience/expertise within your team, then the degree of support offered won’t make a huge difference.

But if you lack internal expertise, you might want to prioritize support. You can seek external assistance to comply with tax regulations, handle complex benefits management, and resolve payroll discrepancies.

When to time your payroll automation switch

While many businesses wait until the end of the tax year to switch providers, you can still start planning for this year.

Waiting might help reduce the amount of data migration needed and make for a slightly cleaner switchover, but the amount of manual work will usually depend on your provider and how much they do for you.

Here are some other factors that you might want to consider:

- Renewal date: Check the renewal date of the current provider’s contract since switching near the end of a contract prevents coverage gaps

- Compliance changes: Watch for upcoming legislation changes and consider transitioning before new laws take effect to ensure compliance

- Seasonality: Depending on your industry, your HR or payroll team might naturally have quieter periods with fewer payroll changes. Choosing one of these quieter periods can minimize disruptions in payroll processing.

Use automation for a stress-free payroll

By switching to an automated payroll solution, businesses can ensure precise payroll calculations, maintain compliance with tax regulations, and improve overall efficiency.

Embrace payroll automation to streamline operations and position your business for growth and success.

Payroll automation FAQ

What are the advantages of payroll automation?

Automating payroll saves time by handling repetitive calculations and payments, makes compliance easier, and significantly reduces the risk of errors.

What are the features of automated payroll?

Automated payroll tools offer a range of features, including data management, automated calculations, payments, and reporting. Automated payroll solutions can also manage shift work patterns, change payday for different months, get payroll approvals without back and forth, and control who can access and interact with your payroll data.

Recommended For Further Reading

- Global payroll systems: Building your multi-national strategy

- What is a payroll cycle?

- UK payroll compliance checklist: Everything you need to know

- Payroll solutions comparison template: Traditional vs. next-gen

- Weekly payroll: How it works and top benefits

- Simplify UK payroll with end-to-end HR and payroll software

When should I start using payroll automation software?

You should invest in payroll automation when the benefits outweigh the risks. Consider switching when frequent errors occur and keeping up with tax laws becomes challenging. You can also use payroll automation software to save time on repetitive tasks and improve overall efficiency.

What kind of payroll platform is best for my business?

At a high level, any company with employees must calculate and distribute wages to employees, so a modern payroll tool, an all-in-one HRIS system, or a legacy ERP can be used. But if manual work and errors are an issue for HR and payroll teams, an all-in-one software solution to minimize manual legwork and calculation errors may quickly bring a high ROI for your business.