Effectively managing payroll plays a key role in building trust and ensuring people are compensated fairly and consistently for their work. But what about those moments that go beyond the usual paycheck—such as celebrating exceptional performance, hitting milestones, or covering extra hours? That’s where supplemental wages come in.

Understanding supplemental wages is essential for HR leaders who want to manage payroll while building transparency and trust. In this article, we’ll explain the types of compensation that qualify as supplemental wages, how they’re taxed, and how they can help retain and motivate your teams.

What are supplemental wages?

Supplemental wages are a form of compensation employers offer in addition to base salary. While regular wages are consistent, either as a pre-agreed salary or an hourly rate, supplemental wages vary from pay period to pay period.

Additional earnings beyond regular pay, such as bonuses or commissions, can be a valuable way to recognize hard work and achievements. Employers must report these payments accurately and ensure they comply with tax regulations.

Certain payments such as overtime pay and tips can be defined as supplemental or regular wages If considered regular wages, the overtime pay and tips are taxed according to the team member’s regular income tax rate rather than a flat supplemental tax rate (22 percent in the United States).

Why should HR leaders care about supplemental wages?

Though supplemental pay doesn’t usually make up the bulk of a compensation package, they’re still important. Supplemental pay can serve as a reward for hard work and achievements or an incentive for people to demonstrate more dedication and a better work ethic.

HR leaders who know the ins and outs of supplemental pay can help ensure professionals know when to expect their pay and what they’re receiving it for. Guaranteeing that the company pays professionals their entire income—both regular and supplemental—is fundamental to building an engaged workforce and maintaining high retention.

However, properly incorporating supplemental wages into people’s pay doesn’t just improve compensation packages. It also allows HR leaders to stay in consistent compliance with federal and state tax regulations.

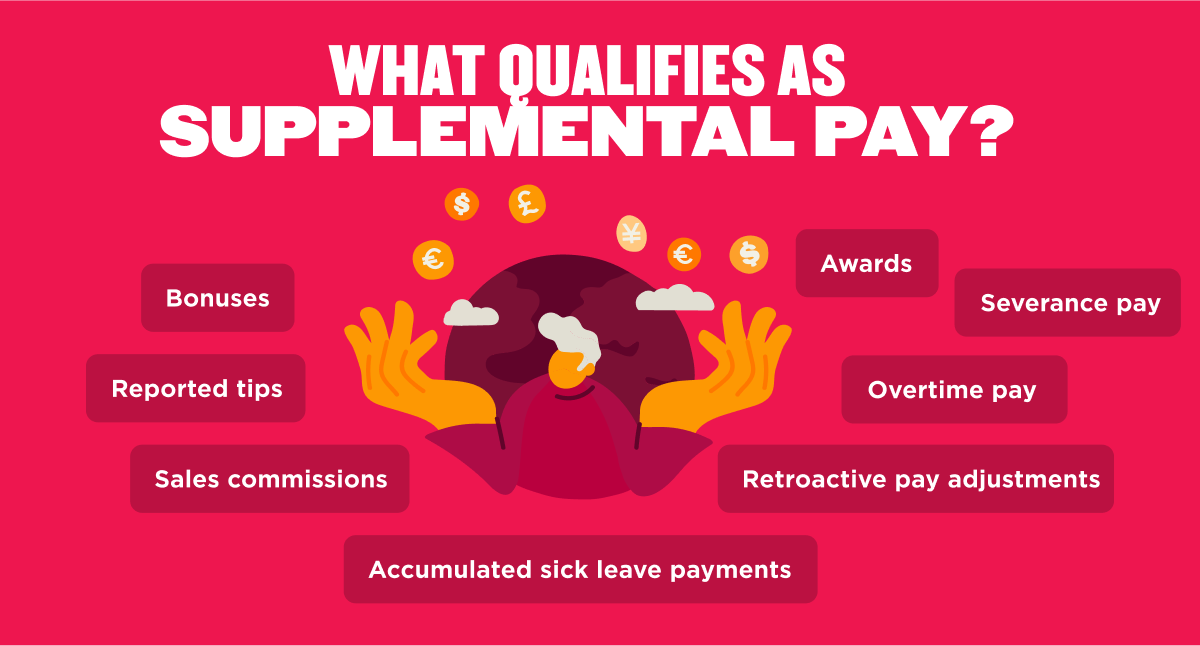

What qualifies as supplemental pay?

While base pay consists of hourly wages or a monthly salary, supplemental pay includes earnings such as:

Bonuses

Performance bonuses recognize exceptional work or overall company success. They can be discretionary—paid ad-hoc for standout performance—or predetermined as part of a structured incentive program. Employers can offer bonuses to reward contributions that meet company objectives, motivate team members, and reinforce a performance-driven culture.

Sales commissions

Sales commissions are supplemental earnings based on a percentage of a team member’s earned sales. This structure directly links compensation to performance, encouraging people to meet or exceed targets for individual growth and company success.

Commissions help incentivize people to deliver strong results since their efforts are directly tied to their rewards. This drives motivation, aligns individual goals with the organization’s objectives, and rewards top talent for their contributions.

Overtime pay

Overtime pay compensates people for hours worked beyond their standard schedule, often at a higher rate. This practice ensures fair pay for extra effort and time invested.

Employers can legally include overtime pay in regular wages rather than separating them as supplemental wages. In this case, overtime is taxed according to the employee’s regular income tax rate, rather than the flat supplemental wage tax rate.

Awards

Awards recognize team members for achievements, milestones, or exceptional contributions. Companies may also offer structured awards such as “Employee of the Month” programs, milestone celebrations for work anniversaries, or departmental awards that celebrate teamwork or innovation.

Accumulated sick leave payments

Accumulated sick leave payments give financial compensation for unused sick days. Payouts occur annually or upon termination. While not all organizations offer payouts for unused sick days, when they do, they’re generally classified as supplemental wages.

Reported tips

While tips are considered supplemental wages, employers can still legally classify them as regular pay on their taxes, since hospitality workers often earn less than minimum wage under the assumption that customer tips will bridge the gap. Team members must report tips to their employer and include all tip income as part of their gross pay on their taxes.

Retroactive pay adjustments

Retroactive pay corrects previous underpayments or applies new wage agreements to past periods. This practice ensures team members get their rightful earnings, which builds trust and keeps organizations compliant.

For payroll purposes, employers may either combine these payments with regular wages in a single paycheck or use the optional flat withholding rate for supplemental wages.

Severance pay

Severance pay gives financial support to people facing termination at an amount that reflects tenure and position. Providing severance ensures financial stability during a job search while helping companies maintain goodwill and protect their reputation.

What doesn’t qualify as supplemental pay?

Some forms of compensation don’t qualify as supplemental pay because they’re fixed obligations or non-taxable benefits. Unlike supplemental wages, which are often variable and performance-based, these payments are tied to existing agreements or legal requirements.

Compensation that doesn’t qualify as supplemental pay includes:

- Regular wages: Fixed salaries or hourly wages earned for standard work hours

- Reimbursements: Payments covering work-related travel expenses or supplies

- Retirement contributions: Employer contributions to pensions or 401(k) plans

- Non-monetary benefits: Perks such as health insurance, childcare subsidies, or meal allowances

- Stock options: Equity compensation granted to team members

- Expense advances: Prepaid funds for business-related costs like conference fees

- Mandatory benefits: Legally required payments, like minimum wage or overtime, under standard payroll

How are supplemental wages taxed?

If employers combine supplemental wages with their people’s regular paychecks, they withhold Social Security and Medicare from supplemental wages, just as they do for standard wages. But, when it comes to withholding federal tax, supplemental wages are subject to specific regulations.

Different payment methods determine how to calculate tax withholdings on supplemental wages. They include:

- Percentage method: In the US, the percentage approach applies a flat rate to supplemental wages. It requires employers to pay the wages separately—or combine them into a single payment and specify the amount of each. According to this approach, the employer withholds tax based on an annual flat rate. This approach differs when determining tax obligations for supplemental wages under or over $1 million.

- Aggregate method: The employer combines supplemental pay with base pay into one total payment and calculates withholding based on this combined amount. This approach is more complex because the higher total means more tax is withheld. The exact amount to withhold depends on the information provided by the employee in their W-4 form.

Supplemental wages under $1 million

In the US, if a professional’s annual supplemental wages are $1 million or less, the employer must withhold 22 percent of the supplemental wages. This simplifies payroll calculations and provides a consistent tax application for various forms of supplemental income, such as bonuses or commissions.

Supplemental wages of $1 million or more

If a professional’s annual supplemental wages exceed $1 million, the employer must withhold 37 percent. This higher rate reflects federal guidelines for high earners and is in compliance with progressive tax principles. Employers withhold taxes separately for these payments and report them accordingly, as regulations are stricter at this income level.

Who is responsible for reporting supplemental wages?

The employer is responsible for reporting supplemental pay. Because of this, companies track how much supplemental pay each person receives annually and whether they distribute supplemental income separately or combined with base pay.

Employers report supplemental wages on tax filings like W-2 forms in the US or P60 forms in the United Kingdom, detailing both taxable income and withholdings. Keeping this information accurate isn’t just a legal obligation—it builds trust with your team through transparency about their earnings and deductions.

Organizations can use dedicated payroll software to help automate payroll and tax workflows, reduce errors, and support compliance with local and federal laws.

How to manage supplemental wages successfully

HR professionals can incorporate these steps to help their company fairly and lawfully implement supplemental pay:

1. Use the company compensation philosophy as a compass

A compensation philosophy can guide HR and finance professionals in integrating supplemental pay into the compensation plan. A budget-based compensation plan can reduce costs, help maintain competitive salaries, and prevent companies from offering supplementary wages they can’t afford. It’s also great for reducing conflict since a coherent compensation package ensures supplemental wages are fair and consistent.

2. Enlist specialist help

Supplemental tax laws are complicated. Collaborating with finance and working with a payroll service can help HR leaders navigate the tricky federal and state laws to ensure compliance.

3. Provide adequate training

Everyone in the workforce should know what their compensation package includes and when and how they’ll receive it. Discussing the payment plan with professionals during onboarding provides them with crucial job-related information and reflects company integrity.

4. Practice comprehensive documentation

Thorough documentation keeps every aspect of supplemental wage management transparent and traceable. Keeping detailed records of payments, including amounts, types, and tax withholdings, will protect organizations from compliance issues.

5. Track pay period data

Accurately tracking pay period data ensures supplemental wages are calculated and recorded correctly within the designated timeframes. Organizations can use payroll software to automatically record all supplemental wages within the relevant pay period, minimizing errors and streamlining compliance efforts.

This approach reduces the risk of discrepancies, allowing you to report earnings and tax liabilities while maintaining clear payroll records.

6. Clearly define types of supplemental pay

Whether it’s severance pay, reported tips, or sales commissions, help your team understand in advance how and when these payments apply. Specify whether you will issue payments separately or alongside regular earnings and communicate the corresponding tax implications.

Keep these guidelines in a self-service knowledge center for people to consult whenever they have questions about supplemental income.

7. Provide regular updates

Regular updates on compensation policies, tax regulations, and supplemental wage practices keep your people informed and confident in their earnings. Proactively share changes through meetings, email newsletters, or HR portals, and provide comprehensive FAQs or guides so colleagues can find answers easily. Designate an HR representative or payroll specialist as a point of contact for inquiries to ensure support is accessible and consistent.

Support your company culture with an effective supplemental wage management strategy

Supplemental wages play a vital role in a well-rounded compensation package. In addition to rewarding people for extra hours and recognizing exceptional contributions, they set the stage for a motivated company culture. HR teams that prepare for effective supplemental wage management with the right payroll systems and workflows can achieve incentivized performance and financial stability during transitions.

A company can promote a healthy relationship with its people by fulfilling their income expectations. Exemplifying honesty regarding supplemental pay demonstrates integrity, helps increase employee satisfaction, and builds a healthy and thriving company culture.

Supplemental wage FAQs

How are supplemental wages different from regular pay?

Regular pay refers to fixed compensation, such as salaries or hourly wages, that team members earn for their standard work hours and responsibilities. In contrast, supplemental wages are variable payments made in addition to regular pay. These include bonuses, sales commissions, overtime pay, or payouts for accrued benefits like unused vacation or sick leave.

One significant distinction is how supplemental wages are taxed. They’re often subject to separate tax withholding rules, which may differ from the standard withholding applied to regular pay.

Is overtime considered supplemental wages?

Some companies treat overtime pay as supplemental wages while others treat it as part of regular wages.

How do employers report supplemental wages on pay stubs?

Employers report supplemental wages on pay stubs by clearly itemizing them separately from regular wages. Each type of supplemental wage—such as bonuses, commissions, or overtime pay—is listed as a distinct entry on the pay stub. This practice helps team members identify the source of each payment and its amount. Alongside each supplemental wage entry, employers indicate the specific tax withholdings applied.

Recommended For Further Reading

What is the supplemental wages tax rate?

The tax rate for supplemental wages varies based on the total amount and the payment method. In the US, for amounts up to $1 million, a flat federal withholding rate of 22 percent applies. For supplemental wages exceeding $1 million, the withholding rate increases to 37 percent. However, additional state or local tax regulations may also influence the final amount withheld.

In the UK, supplemental wages receive the same tax treatment as regular income. This means they simply raise your taxable rate and require the same deductions as a regular salary of the same amount.