Need a brush-up on payroll year-end before navigating the busiest time of the year for payroll professionals?

Whether you’re a seasoned payroll manager or spinning many other plates in addition to payroll, we’ll make sure you leave no stone unturned when it comes to wrapping up payroll for the tax year and getting yourself ready for year-end payroll.

What is year-end payroll?

HR or finance teams follow standard year-end payroll processes to calculate team member payments and deductions and report them to His Majesty’s Revenue and Customs (HMRC).

Payroll administrators conduct this process after the final payroll run of the tax year, which typically ends on April 5. They prepare and submit the final Full Payment Submission (FPS), issue P60 forms to team members, and pay any outstanding tax or National Insurance contributions to HMRC. These actions confirm that the organization’s payroll records are accurate and compliant with UK tax laws.

When is payroll year-end?

The tax year in the United Kingdom ends on April 5 each year and starts again on April 6.

Key dates to keep track of for year-end payroll

There are also some other key dates that are essential to keep track of throughout the tax year. Some of the most crucial dates tend to be around the beginning and end of the tax year.

- April 5: End of previous tax year

- April 19: End of tax year filing deadline

- May 31: Deadline to provide team members with P60s

- July 6: Deadline to report benefits (P11D and P11D(b))

- April 6: Beginning of new tax year

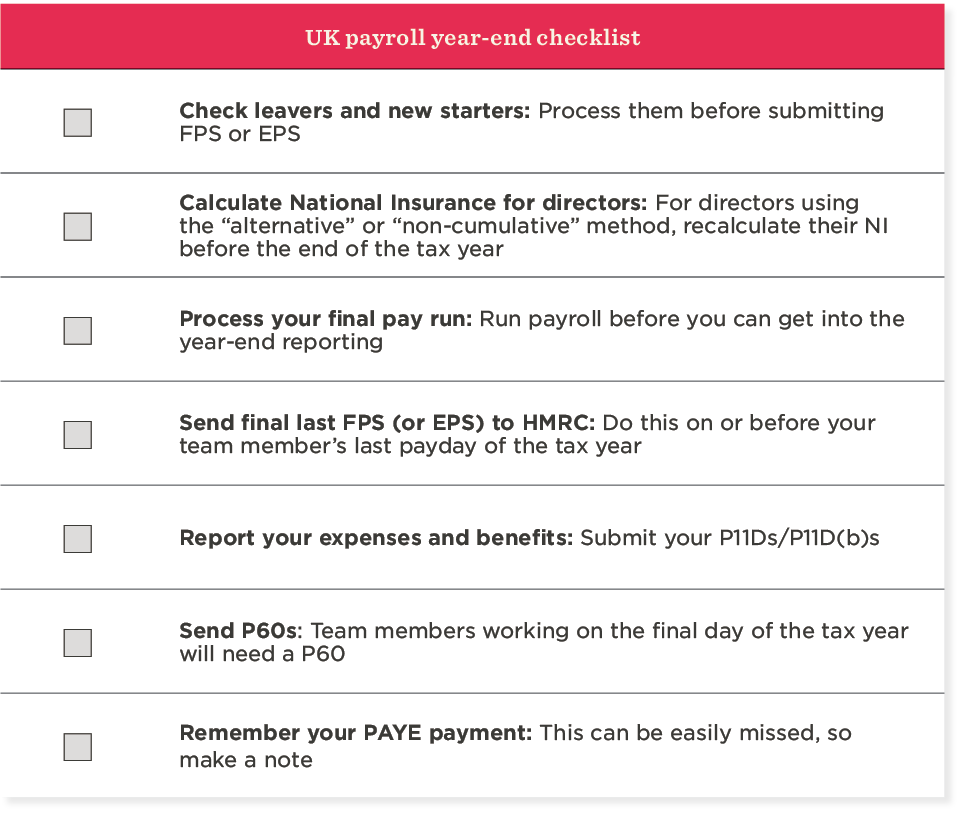

Payroll year-end checklist for UK businesses

UK businesses can use this comprehensive checklist when processing the final payroll of the year for their business:

1. Update team member records

When we talk about “team member records,” we mean any information and documentation related to each individual team member—names, addresses, employment details, salary, benefits, tax codes, and others.

The payroll department must carefully review and update the following records:

- Check for leavers or new starters: If there have been new hires, put their information into the payroll system. And for terminated team members, be sure to update records accordingly.

- Tax code updates: Check for any updates to HMRC tax codes and adjust team member records where necessary.

- Pension contributions: Make sure pension contribution details are up to date. Update records for any changes in pension contributions, especially if the team member has opted for adjustments.

- Holiday and leave balances: Review holiday and leave balances for each team member.

- Bonuses and overtime: Update records for any bonuses or overtime payments.

Deadline: Before making final pay run

2. Send your final full payment submission (FPS)

A full payment submission, or FPS, refers to a detailed report submitted to HMRC providing real-time information about team members’ earnings, tax, and National Insurance contributions. Payroll teams submit them whenever they make a payment to a team member.

Your FPS will let HMRC know about all of the payments and deductions you’ve made over the course of the year. And at the end of the tax year, you send your last FPS either on or before your team member’s last payday of the tax year, just like you would for any other month.

You can do this using your payroll software—just be sure to select “Yes” in the “Final submission for year” field in whichever software you’re using. This lets the HMRC know that this is the final submission for the tax year so they won’t be expecting any more.

For your final FPS submission, you:

- Include all team members who got paid in the tax year (regardless of the amount)

- Include all team members who got paid in the tax year, even if they’ve since left

- Make sure you select “Yes” in the “Final submission for year” field

- Submit before your final payday

If you run more than one payroll under the same PAYE scheme reference, you can include the end-of-year information in your final report.

Deadline: April 19

3. Submit your final employer payment summary (EPS)

In some cases you may need to submit an employment payment summary (EPS) as well as an FPS. Organizations submit employer payment summaries if any payments need recovering, like statutory payments or apprenticeship levy.

You might need an EPS If:

- You forgot to put “Yes” in the “Final submission for year” field when submitting your FPS

- Your payroll software doesn’t have a “Final Submission for year” field

- You didn’t pay anyone in the final pay period of the tax year

- You sent your final FPS early and then didn’t pay any team members for at least one full tax month in the last tax year

If you’re submitting an EPS relating to Month 12 of the tax year (March 6—although Month 12 can spill into April 5) and you’re submitting after your final FPS, you’ll need to mark the EPS as final—the same as you would for the FPS submission.

Deadline: April 19

4. Prepare and send team members their P60s

Companies use P60s to summarize a team member’s total pay and deductions for the year—they contain all the payslips a team member receives over the year. Every team member you have working for you on the final day of the tax year will need to get a P60 by May 31.

Most payroll software should allow you to generate and send P60s, similarly to how you would usually send payslips. You can also print them off manually if you’re exempt from running your payroll online.

(Order your P60 forms directly from HMRC here.)

Make sure your team members only receive their P60s after you’ve provided the final payslip. This ensures the P60 form includes all payroll information for the tax year.

Deadline: May 31

5. Report on expenses and benefits

You can report on expenses and benefits using P11Ds and P11D(b)s.

Using P11Ds

Employers submit P11D forms to HMRC on behalf of every team member. These forms detail taxable benefits, such as company cars, accommodation, or other benefits not previously reported through payroll or a PAYE Settlement Agreement.

At the end of each tax year, you’ll submit a P11D form to HMRC for every team member you’ve given expenses or benefits to. This only applies if benefits aren’t payrolled. You don’t need P11Ds if you report benefits throughout the year via payrolling.

You can send the document to your team members so they can quickly double check that everything is accurate before you send them off to HMRC. You may also want to hold onto a copy of the P11Ds to make record keeping easier.

You can usually submit P11Ds through your payroll software.

Deadline: July 6

Using P11D(b)s

Every company submits the P11D(b)s yearly. This form contains the amount of Class1A National Insurance Contributions due on certain benefits already paid to team members. P11D(b)s outlines the total value of benefits subject to Class1A National Insurance and the sum due from the employer.

You submit a P11D(b) to let HMRC know how much Class 1A National Insurance you need to pay on any expenses and benefits you’ve given your team members.

If you submit any P11Ds or payroll benefits, this means you’ll also need to submit a P11D(b) too. If you’re payrolling benefits, you don’t need to submit P11Ds, but you will still need to submit a P11D(b) form.

Deadline: July 22 (or July 19 if you’re paying by check)

6. Calculate National Insurance for directors

The company calculates directors’ NICs differently from team members’ NICs, since they have a different set of rules. Directors often receive a combination of salary and dividends, impacting their NIC liability.

When calculating National Insurance Contributions (NICs) for directors, consider:

Directors who choose the “standard” or “cumulative” method of calculating national insurance can track NI payments fairly easily. These methods will automatically calculate NI based on payments made over the year.

For directors using the “alternative” or “non-cumulative” method, you’ll need to recalculate their NI before the end of the tax year. The calculation should include their total NIable pay for the entire year.

If you find that there wasn’t enough NI deducted from their yearly earnings, they’ll get a chance to pay up in Month 12. Or if they paid too much, there will be a refund.

Deadline: April 19 (submitted in FPS)

7. Don’t forget your Pay As You Earn (PAYE) Payment

You must make payments to HMRC to pay over any PAYE deducted from your team members’ earnings.

You need to make PAYE payments every month, regardless of the time of year.

You should make a note of your PAYE payment to ensure you don’t forget it among the many tasks you need to complete before the new tax year.

Deadline: April 22 if paying electronically, April 19 if paying by cheque

8. Final note: Double check for any updates to HMRC guidelines

Although payroll software can help you stay on top of any legislation changes, you may still want to check for any changes in tax codes, allowances, or reporting requirements.

You can see any major changes that might affect how you do payroll via HMRC’s employer bulletins.

<<Streamline your compliance efforts with this free payroll year-end checklist.>>

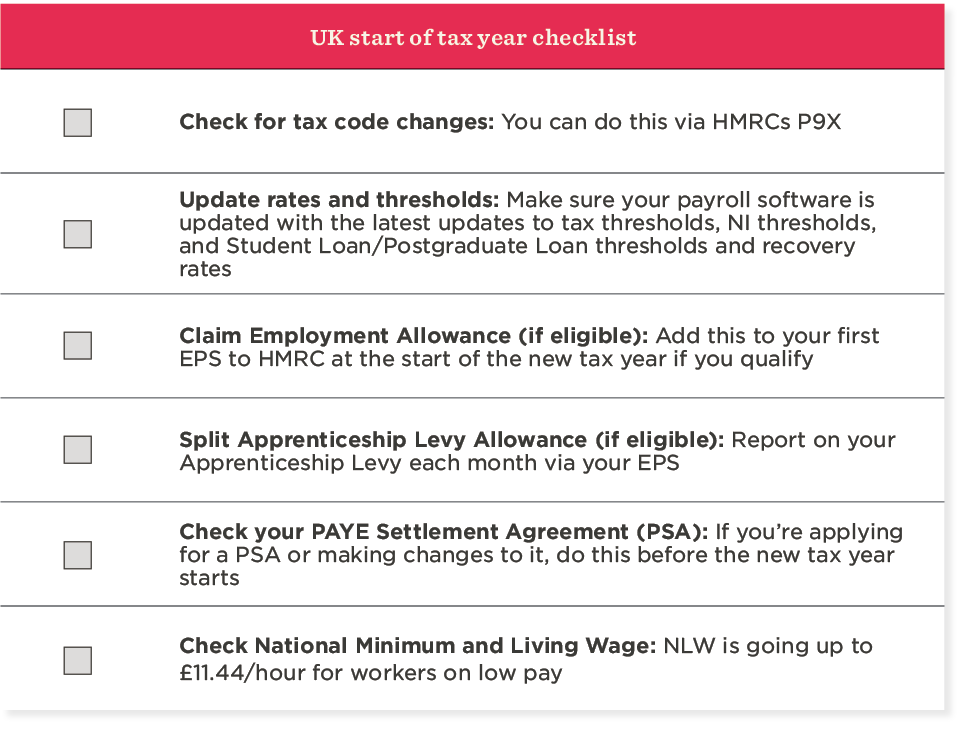

Preparing for the new tax year: Key tasks for UK businesses

You’ve closed the books on another tax year – now it’s time to gear up for the next!

As a UK business owner or payroll manager, you can kickstart your new tax year preparations with these essential tasks:

Check your PAYE Settlement Agreement (PSA)

Employers can establish a PAYE Settlement Agreement with HMRC, allowing them to settle the tax and NICs on specific types of expenses and benefits. This arrangement simplifies the tax treatment of these items and reduces the administrative burden for both employers and team members.

If your team members receive minor, irregular or impractical benefits, you might be able to report them under a PSA, where you would pay the tax and National Insurance on behalf of team members related to these benefits.

If you’re planning to apply for a PSA or make changes to it, you’ll want to do this prior to the start of the tax year to make reporting any of these benefits easier. Already have a PSA? Then, you may want to just check for all relevant benefits.

Look for any changes to the National Minimum and Living Wage

The National Minimum Wage (NMW) and the National Living Wage (NLW) are statutory minimum wage rates set by the UK government to ensure workers receive a fair and legal level of remuneration for their work.

On April 1 each year, the NMW and NLW rates change. They also change on your team members’ birthdays if their age qualifies them for a new NMW bracket. This means you’ll also need to uplift a team member’s hourly rates to match the rates to their age.

NMW applies to team members up to 22 years old, while NLW applies to team members aged 23 and over (this will change April 2025 to be applicable from age 21 and over).

For the 2024/2025 tax year, the NLW is getting a bump of 9.8 percent, taking it to £11.44 per hour for workers on low pay. National Insurance (NI) will be cut by over 15 percent. This will save UK team members earning an average salary of around £450 a year.

You can also check them out via HMRC’s website.

Apprentices aged 19 or under, as well as those in the first year of their apprenticeship, are entitled to an apprentice rate of pay. After the first year, they should receive NMW for their age.

Check the P9X and update tax codes

HMRC issues the P9X document, which explains how to uplift personal allowances if applicable. Check the P9X before you start your first monthly or weekly payroll for the new tax year.

HMRC will send you a P9X form that contains any changes for team members with tax codes ending in “L.” The L code usually means a team member is entitled to the standard tax-free Personal Allowance.

If the standard personal allowance has been changed, you must ensure that tax codes are updated accordingly.

If your team members have not been given a new tax code, you’ll need to remove any Week 1/Month 1 indicator from the tax codes carried over into the new tax year.

You can check HMRC’s P9X tax codes here.

Stay on top of rates and thresholds

Rates and thresholds dictate deductions from team members’ salaries. You’ll want to make sure whatever payroll solution you’re using syncs with the latest updates to tax thresholds, NI thresholds and rates, and Student Loan and Post-Graduate Loan thresholds and recovery rates.

- Tax thresholds: Be mindful of any changes to tax bands, such as the basic, higher, and additional tax rate bandings.

- NI thresholds and rates: National Insurance becomes payable when it reaches particular thresholds and at different rates, depending on your NI category. These may vary each tax year, so ensure you stay informed (and ideally use payroll software that can help you keep up).

- Student Loans and Postgraduate Loans: The point at which student and post-grad loans become repayable can vary from year to year, as can the rates for repayment.

The UK government has stated that for the Personal Allowance, the basic rate limit and various NICs thresholds will stay at their current levels until April 5, 2028.

Want to avoid excessive team member queries? Be aware of any changes in regulations that may affect your team members’ net pay. For example, the government may raise the Student Loan threshold. When this happens, a team member who was already close to the threshold in March might find their pay dropping beneath the new limit in April, which means they no longer make repayments.

For the 2024/2025 tax year, The Department for Education in the UK has confirmed the Student Loan thresholds for Plan Type 1 and 2 to be operated from April 6, 2024.

From April 6, 2024, the repayment threshold for pre-2012 (Plan 1) loans will rise to £24,990. The income threshold for post-2012 (Plan 2) from April 2024 will remain frozen at £27,295.

Check your eligibility to claim employment allowance

The government offers the employment allowance as a yearly perk. This allowance enables you, as an employer, to reduce your Class 1A National Insurance contributions.

Are you eligible to claim the employment allowance perk? Here’s HMRC’s criteria:

- If you’re a business or charity (including community amateur sports clubs) and if your employer’s Class 1 NI liabilities were less than £100,000 in the last tax year

- If your business is not linked to any other organization (here’s what constitutes a “connected company”)

If you qualify, don’t forget to flag this on your first EPS to HMRC at the start of the new tax year and inform them which sector you belong to.

Split the Apprenticeship Levy allowance

The UK government introduced the Apprenticeship Levy to promote apprenticeship programs. As an employer, you must pay 0.5 percent of your payroll costs to help fund apprenticeship courses. If you operate multiple companies or payrolls, you need to split this allowance among them.

If you’re responsible for running payroll, chances are you already know that companies have to pay apprenticeship levy if they meet the £3 million annual bill threshold.

But what you might not know is that you might be able to use the £15,000 allowance to offset this. If you are connected to another company, you can split the £15,000 allowance.

You can report on your Apprenticeship Levy each month using your EPS (your payroll software may allow you to do this).

<<Support your people with this free payroll year-end checklist.>>

Streamline your UK payroll

Experienced payroll managers in the UK know that year-end is hectic–especially in large organizations.

Businesses or managers can make payroll year-end error-free by outlining key deadlines and milestones to keep everyone on track. They can also use payroll software to reduce the risk of errors, review tax codes and employment laws to ensure compliance, and review payroll data to catch and correct errors.

<<Download our free year-end checklist to keep year-end payroll running smoothly.>>

Payroll year-end FAQ

What is the payroll tax year in the UK?

In the UK, the tax year ends on April 5 and starts again on April 6.

Recommended For Further Reading

What should you do for payroll year-end?

Key tasks include:

- Checking leavers and new starters

- Sending final last FPS to HMRC

- Submitting your P11Ds/P11D(b)s

- Send P60s to team members

<<Download our free payroll year-end checklist.>>

What is the payroll year-end submission deadline in the UK?

The payroll year-end submission deadline is typically on or before April 19. You’ll need to submit your final payroll report (including the Final Full Payment Submission) to HMRC by this deadline.