When you’re working in the world of HR and payroll, you’ve got a lot to keep on top of.

From managing teams and ensuring compliance with changing regulations to maintaining seamless data integration and accuracy, the list of responsibilities can seem endless.

Choosing the right payroll system is another critical decision that can make a big impact on organizational success.

That’s why we’ve put together this payroll service comparison, designed to guide HR and payroll professionals through a comprehensive weighing-up of traditional and next-gen payroll systems.

Throughout this piece, we’re going to focus on four essential pillars:

- Team member experience

- Data integration

- Accuracy and compliance

- Reliability

These pillars give us a foundation for understanding how next-gen payroll compares to traditional systems and present us with a chance to compare them side by side.

Ready? Let’s get started.

<<Download our payroll solutions comparison template to find the right fit for your business.>>

What is next-gen payroll?

Before we start our comparison, let’s talk about what next-gen payroll actually is.

This refers to modern payroll systems that use advanced technology to give a more seamless, integrated, and user-friendly experience than traditional payroll systems.

They offer benefits such as real-time error detection and correction, automated compliance updates, and robust data integration.

All in all, they ensure that your payroll processes are efficient, accurate, and, perhaps most importantly, reliable.

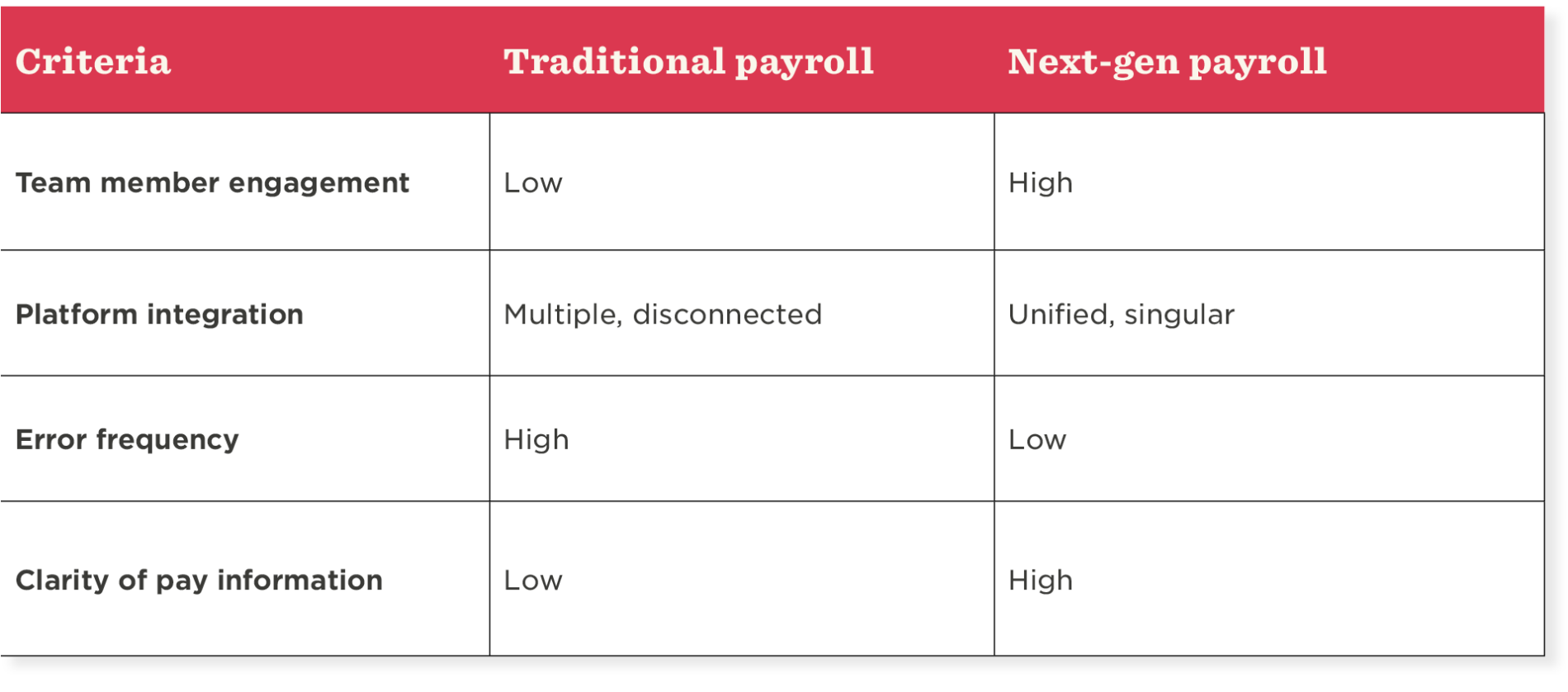

Team member experience

What is the team member experience?

Team member experience refers to the overall journey a team member has at your organization. This relates to everything from interactions a person has with their team and how they perceive their role, to the culture, and the systems and processes they interact with every day.

A positive experience is vital, as a happy team member is far more likely to maintain high levels of engagement, satisfaction, loyalty, and productivity.

Traditional payroll

When it comes to the team member experience, traditional payroll systems may face challenges in engaging team members, which can affect trust and satisfaction.

These systems typically involve cumbersome processes, are split across multiple platforms, and may experience errors that can make it difficult for team members to get transparency on their pay.

On top of this, the lack of integration and real-time updates can affect efficiency and satisfaction.

And, according to a survey HiBob conducted with Pollfish, more than 70 percent of companies have a rigid cutoff date for payroll, which can stall the onboarding of new hires and further frustrate team members.

Next-gen payroll

Next-gen payroll solutions provide a seamless, team member-friendly experience, reducing errors and boosting clarity and transparency.

Designed to help engage team members, these systems build and foster trust and satisfaction at every level. This is because next-gen payroll systems are specifically built with people in mind, offering intuitive interfaces and easy-to-access pay information.

Key features

- A unified platform for HR and payroll information. Allowing people to access all of their data in one place.

- Real-time error corrections and transparent pay information. Reducing the chances of payday errors and delays.

Enhanced user experience with self-service portals. Allowing people to view their pay slips, tax information, and other important documents.

<<Download our payroll solutions comparison template to find the right fit for your business.>>

Traditional vs. next-gen payroll

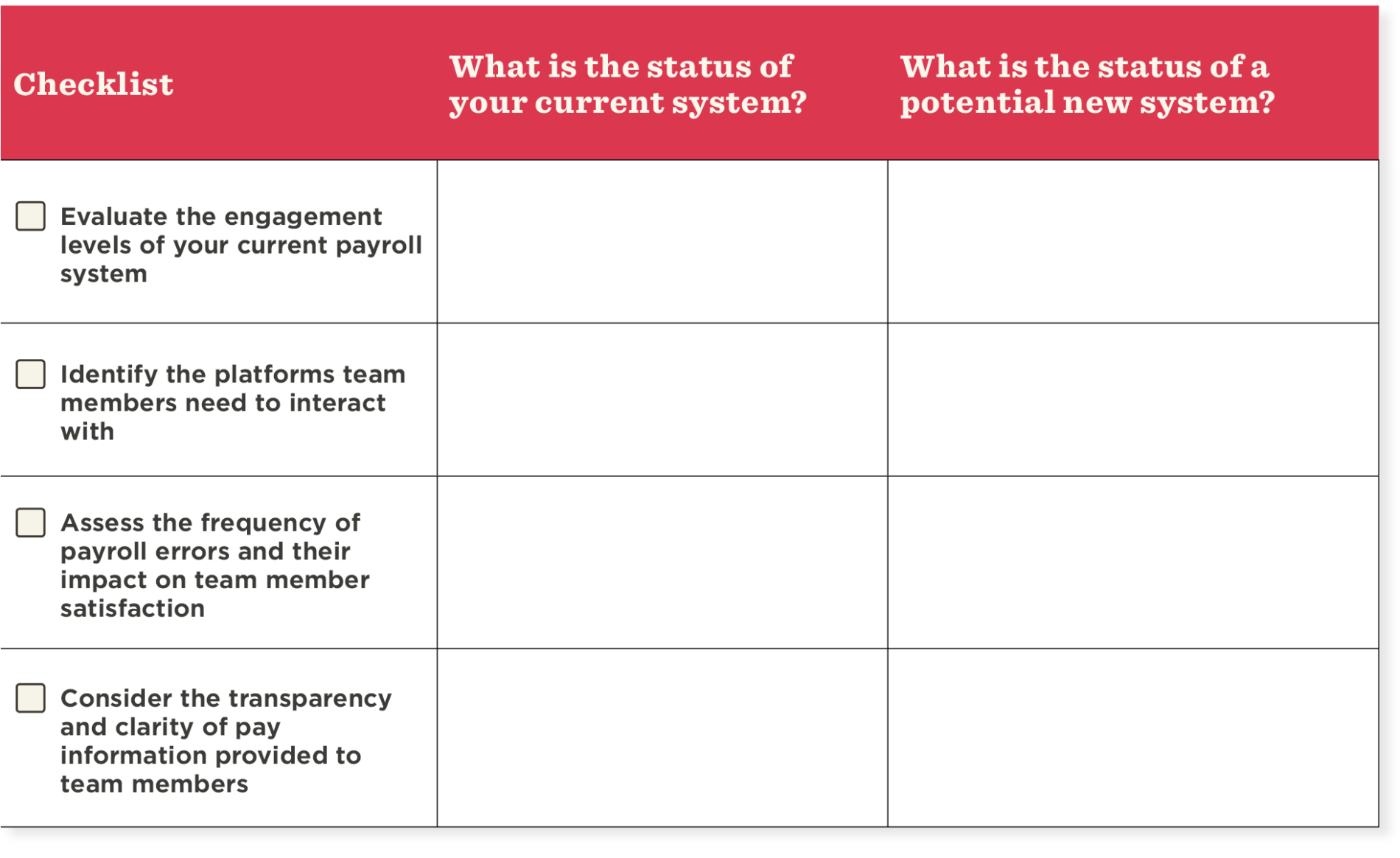

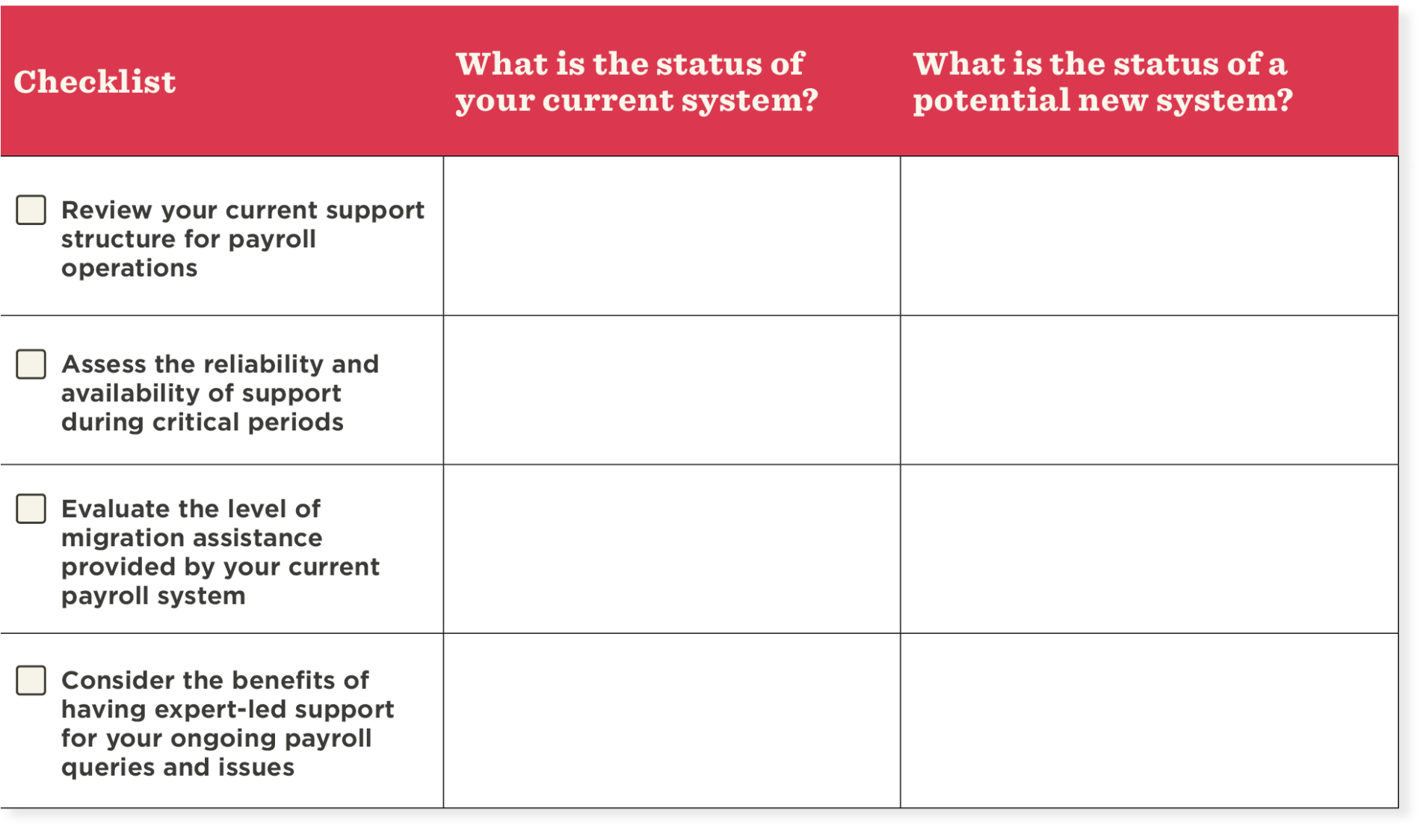

Checklist summary template

<<Download our payroll solutions comparison template to find the right fit for your business.>>

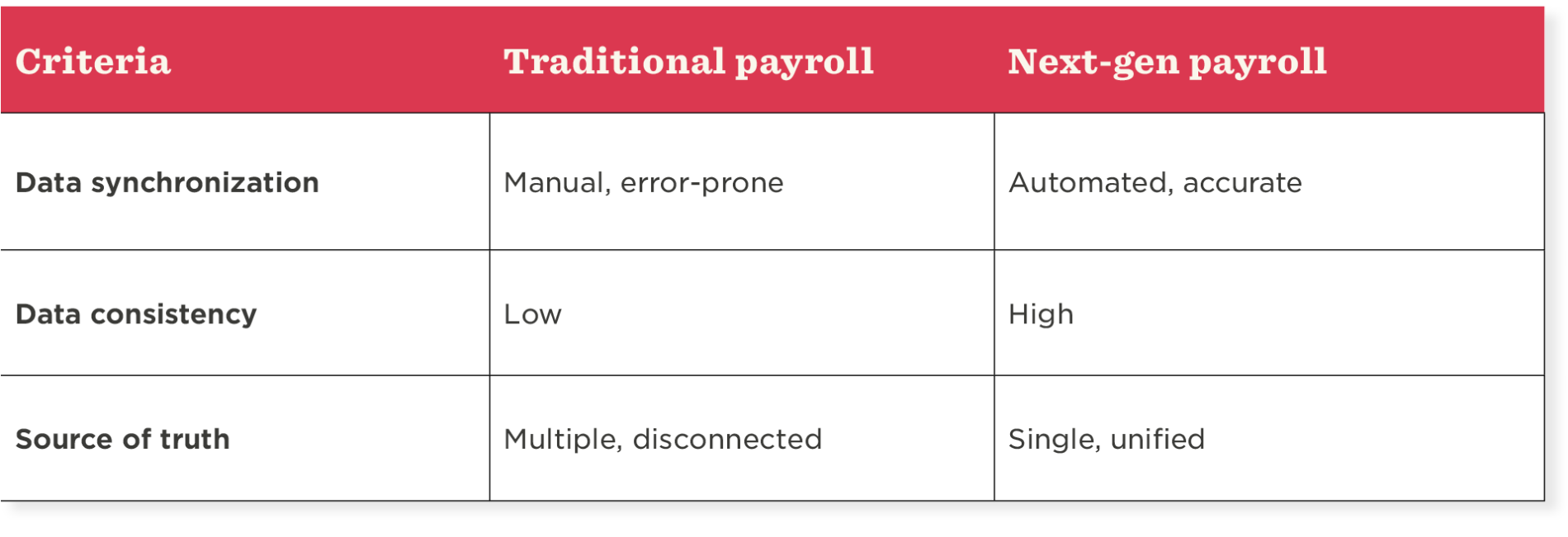

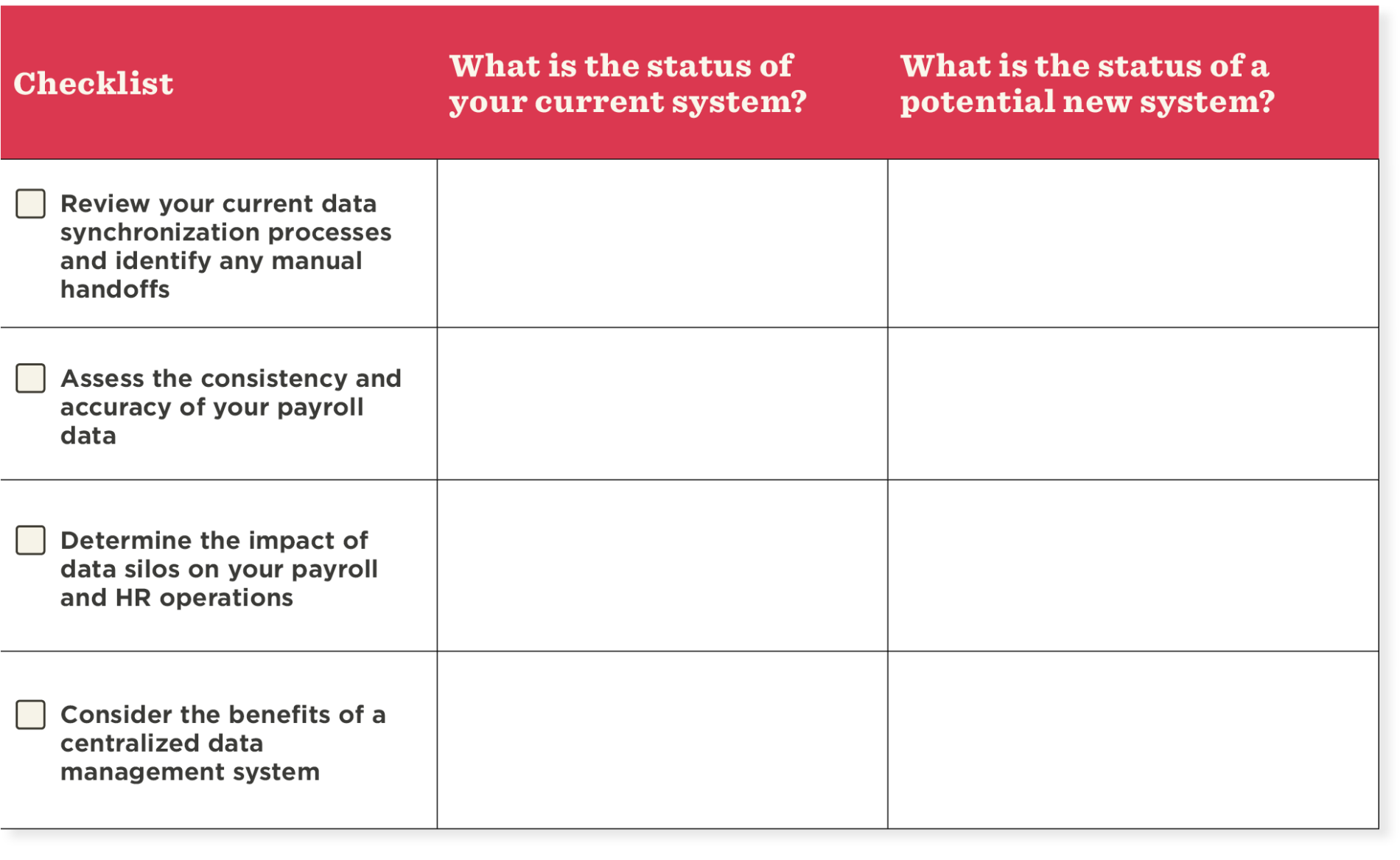

Data integration

What is data integration?

Data integration refers to the process of combining data from various sources to give you a unified view.

When you put data integration into the context of payroll, it involves synchronizing HR and payroll data to make sure everything is consistent and accurate across the board, as well as providing ease of access.

By having effective data integration, you can eliminate data silos and manual handoffs—which in turn reduces errors and boosts your efficiency.

Traditional payroll

Traditional payroll systems often operate in silos, which can make data collation and analysis more complex, requiring manual handoffs.

When there’s a lack of integration, data has to be manually transferred between systems. This approach can create challenges for HR and payroll professionals, increasing the likelihood of inefficiencies and errors.

Other issues include data duplication, manual process errors, and a lack of one unified source of truth.

All of these factors mean that the time spent on payroll every month is significant. Data from HiBob and Pollfish shows that the time spent can range between one to five days for a smaller company with 50-200 team members, to more than 10 days for larger companies with 200-500 team members.

Next-gen payroll

Next-gen payroll solutions offer a far more seamless experience with data integration. They provide a single source of truth for all HR and payroll data, removing siloed information and ensuring data is consistent, accurate, and readily available.

Furthermore, automated processes reduce the need for manual intervention, which minimizes the risk of errors and cuts down on time.

Key features

- Automated data synchronization between HR and payroll systems. This ensures any changes made in one system are automatically changed in the other.

- Elimination of manual data entry and handoffs. Reducing the workload of HR and payroll teams.

- Centralized data management. Providing a full, unified view of all payroll and HR information.

Traditional vs. next-gen payroll

Checklist summary template

<<Download our payroll solutions comparison template to find the right fit for your business.>>

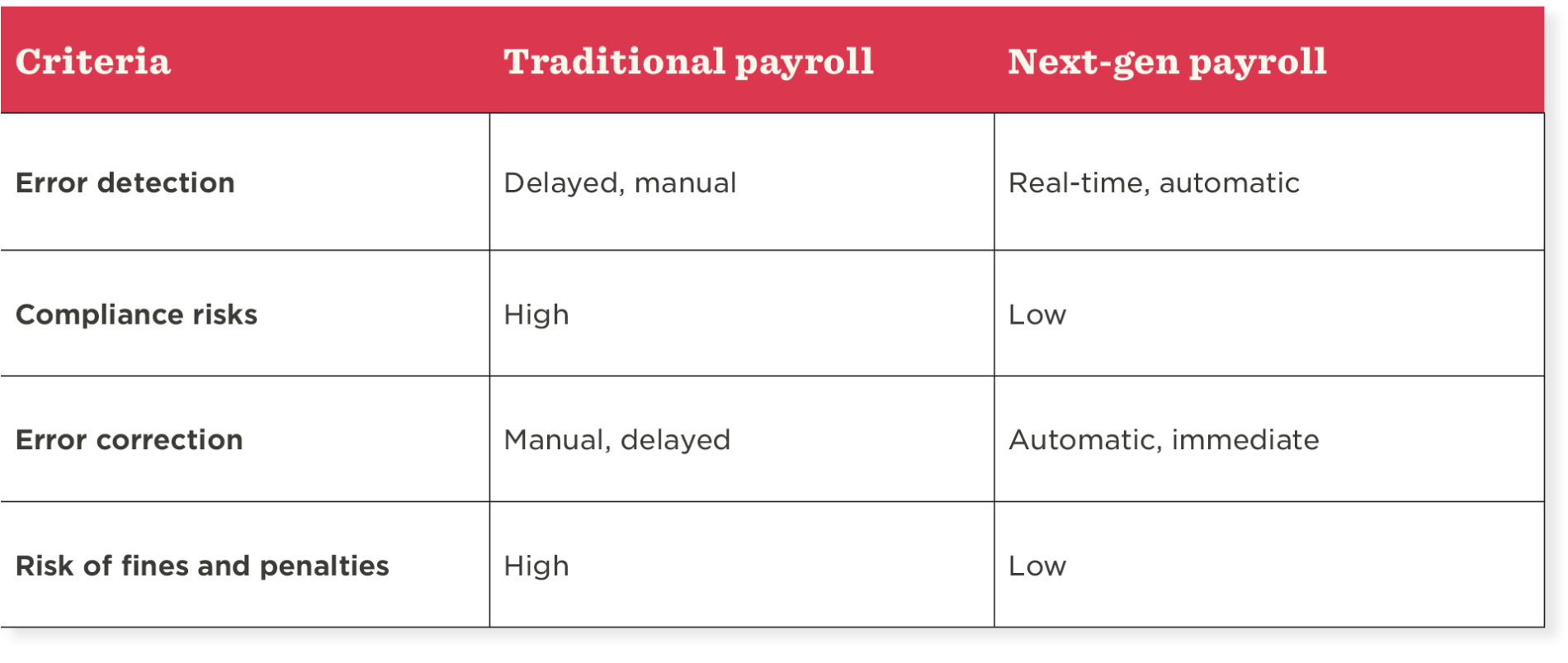

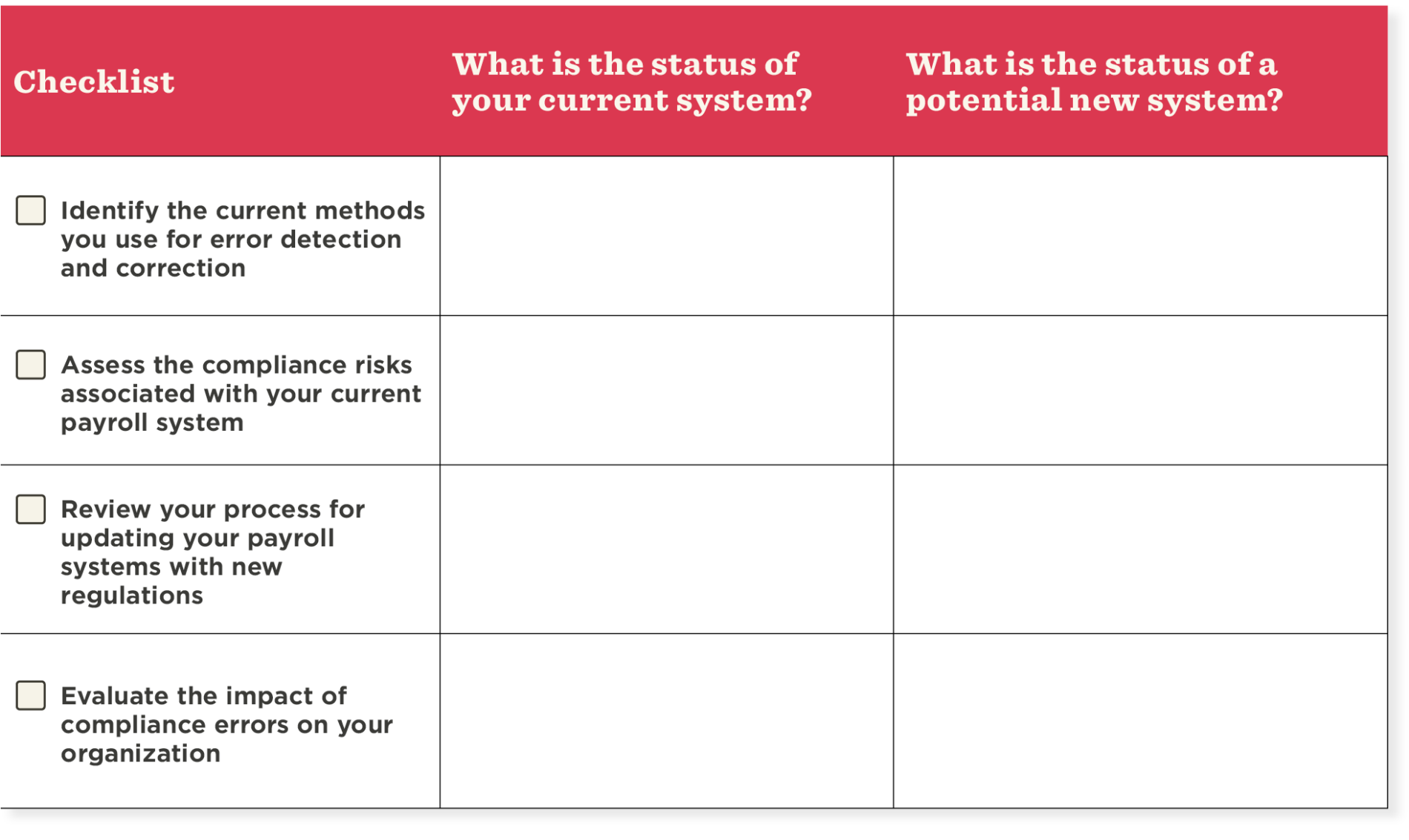

Accuracy and compliance

What is accuracy and compliance?

Accuracy in payroll refers to the correct calculation and distribution of your people’s wages, taxes, and deductions. On the other hand, compliance involves all things legal and regulatory, and makes sure that your organization meets these requirements.

Ensuring accuracy and compliance is incredibly important, as if you stray from the mark you can be hit with legal penalties. It also helps you to avoid financial discrepancies and maintains team member trust.

Traditional payroll

Maintaining accuracy and compliance with traditional payroll systems can be tricky. They often require manual interventions and constant monitoring to ensure nothing slips by without being flagged.

Due to the complex nature of payroll regulations and frequent updates, ensuring compliance can feel like a mammoth task.

Common issues that occur with traditional payroll systems include compliance challenges, delayed error detection, and a higher risk of fines and penalties due to inaccuracies.

In fact, in the UK, 88 percent of companies face HMRC penalties on a yearly basis due to payroll errors—highlighting the need for a more thorough and error-proof process.

Next-gen payroll

Next-gen payroll systems are designed to ensure continuous compliance and accuracy by detecting and correcting errors in real-time, helping to minimize risks. They’re also designed to stay updated with the latest regulatory changes, meaning you don’t have to manually adjust when rules evolve over time.

Key features

- Real-time error prompts and automatic corrections. Allowing you to immediately resolve any discrepancies.

- Integration with compliance requirements and automatic updates. Ensuring that your system is always up to date with the latest regulations.

- Advanced reporting capabilities. Providing you with detailed insights into payroll operations and compliance statuses.

Traditional vs. next-gen payroll

Checklist summary template

<<Download our payroll solutions comparison template to find the right fit for your business.>>

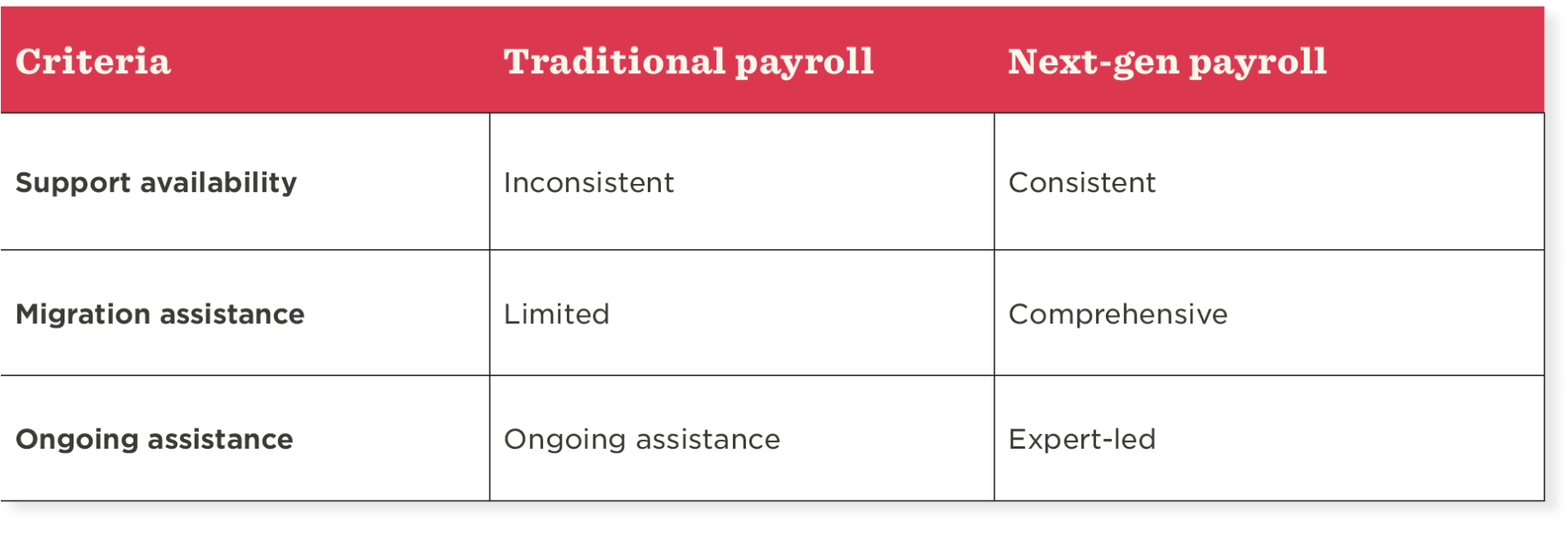

Reliability

Reliability in payroll is all about the dependability and consistency of your operations. For your team members to feel safe and secure about their pay, it’s vital to make sure payments are timely and accurate.

But reliability also encompasses the support and assistance you provide as well as the overall stability of your payroll system.

A reliable payroll system ensures that people are paid accurately and on time, every time.

Traditional payroll

Reliability can be a consideration when discussing traditional payroll systems. The conversation may include the need for consistent support and flexible processes to ensure smooth payroll operations.

Traditional payroll systems can also lack the flexibility and agility needed to adapt to changing business needs, which can lead to operational inefficiencies further down the line.

Common pain points include a lack of support during critical times such as holidays, and managing the workload on internal teams for migration and daily queries.

There are also additional fees for changes during payroll windows to consider. HiBob’s research with Pollfish shows that 65 percent of employers get charged an additional fee if they submit any changes after the payroll deadline, which can further complicate an already complicated process and add an extra layer of financial strain.

Next-gen payroll

Next-gen payroll systems offer a far more reliable, expert-led experience from migration to daily operations. The system ensures consistent and dependable payroll processing and continuously provides support—even during peak times.

They are also able to offer expert guidance to help payroll professionals and organizations navigate complex payroll challenges.

Key features

- Consistent and reliable support, even during peak times. Ensuring that payroll operations can run smoothly without any unnecessary interruptions.

- Comprehensive migration support and ongoing assistance. Helping organizations transition to the new system seamlessly.

- Expert-led support. Providing specialized knowledge and advice to address any payroll-related queries or issues.

Traditional vs. next-gen payroll

Recommended For Further Reading

Checklist summary template

<<Download our payroll solutions comparison template to find the right fit for your business.>>

A next-gen solution to present-day challenges

Next-gen payroll systems offer clear and significant advantages over traditional payroll solutions.

By reflecting on the four pillars of team member experience, data integration, accuracy and compliance, and reliability, we can see that next-gen systems not only measure up to the traditional systems but far surpass them in key aspects such as ease of use, efficiency, and overall performance.

Traditional payroll systems will often involve manual processes, disconnected data, and inefficiencies. In contrast, next-gen payroll systems offer integrated, automated, and accurate solutions that can boost the team member experience, ensure data consistency, maintain compliance, and provide reliable support.

Use our checklist template to evaluate your current payroll system and explore how switching to a next-gen payroll solution like Bob can transform your organization.