When it comes to managing payroll, staying compliant with UK regulations can be tricky. But while UK regulations come with their fair share of rules and deadlines, staying compliant can be simpler than you might think.

Keeping up with payroll compliance doesn’t have to be a headache, especially with the right payroll management tools at your disposal. That’s why we’ve created this easy-to-use, straightforward guide and UK payroll compliance checklist to walk you through everything you need to know.

<<Download our comprehensive UK payroll compliance checklist in PDF format here.>>

What is payroll compliance?

In a nutshell, payroll compliance essentially means adhering to payroll legislation laid out by HM Revenue & Customs (HMRC) (things like payment of wages and taxes).

To be HMRC compliant, you’ll generally need to ensure your payroll is accurate, salary payments are timely, and that your PAYE deductions are error-free.

Keeping your organization up to date with payroll compliance doesn’t necessarily have to be difficult—especially if you’re using a payroll solution—but any breaches can come with fairly hefty fines.

Non-compliance penalties can add up

Depending on the size of your organization, payroll-related fines and other payroll costs can range from a few hundred pounds to millions of pounds.

In 2018, for example, Pizza Hut faced a fine of £12,000 after an HMRC investigation found that they failed to pay the National Minimum Wage to over 2,500 workers.

But way back in 2016, Tesco caught an eye-watering £129 million fine by the Serious Fraud Office (SFO) for accounting irregularities.

Here are the payroll compliance penalties you’ll want to steer clear of:

Late filing

A late filing occurs if you don’t submit your Real Time Information (RTI) – FPS/EPS on time.

If you have up to nine people in your team, the penalty starts at £100 for the first missed deadline. For larger employers, the penalty increases depending on the number of team members, ranging from £200 to £400 for subsequent missed deadlines.

Late payment

A late payment is if you fail to pay any PAYE to HMRC on time.

The penalty amount can vary depending on the length of the delay and the amount of tax owed. For example, if you are one to three months late in paying, the penalty can be 1 percent of the outstanding amount.

Inaccurate reporting

If your payroll reports contain mistakes or inaccuracies (such as team member details, earnings, or payroll deductions), they will be classified as inaccurate reporting.

The penalty is based on a percentage of the tax underpaid, which can range from 15 percent to 100 percent, depending on the severity of the inaccuracy.

Not providing accurate records

You’re required to keep up-to-date payroll records, which HMRC may request.

The penalty amount can be up to £3,000 depending on the number of team members and the duration of non-compliance.

Note: If you’re a first-time employer: you’ll need to actually register as an employer if you want to avoid being fined.

Before hiring team members, you’ve got to register as an employer with HMRC and ensure that you complete the HMRC new starter checklist to avoid any compliance issues.

You’ll then be able to get an employer reference number, which you’ll need for payroll operations.

You’ll also need to register for the Pay-As-You-Earn (PAYE) system, so you can calculate and deduct income tax and National Insurance contributions (NICs) from your team members’ wages.

<<Download our comprehensive UK payroll compliance checklist in PDF format here.>>

Your payroll compliance checklist

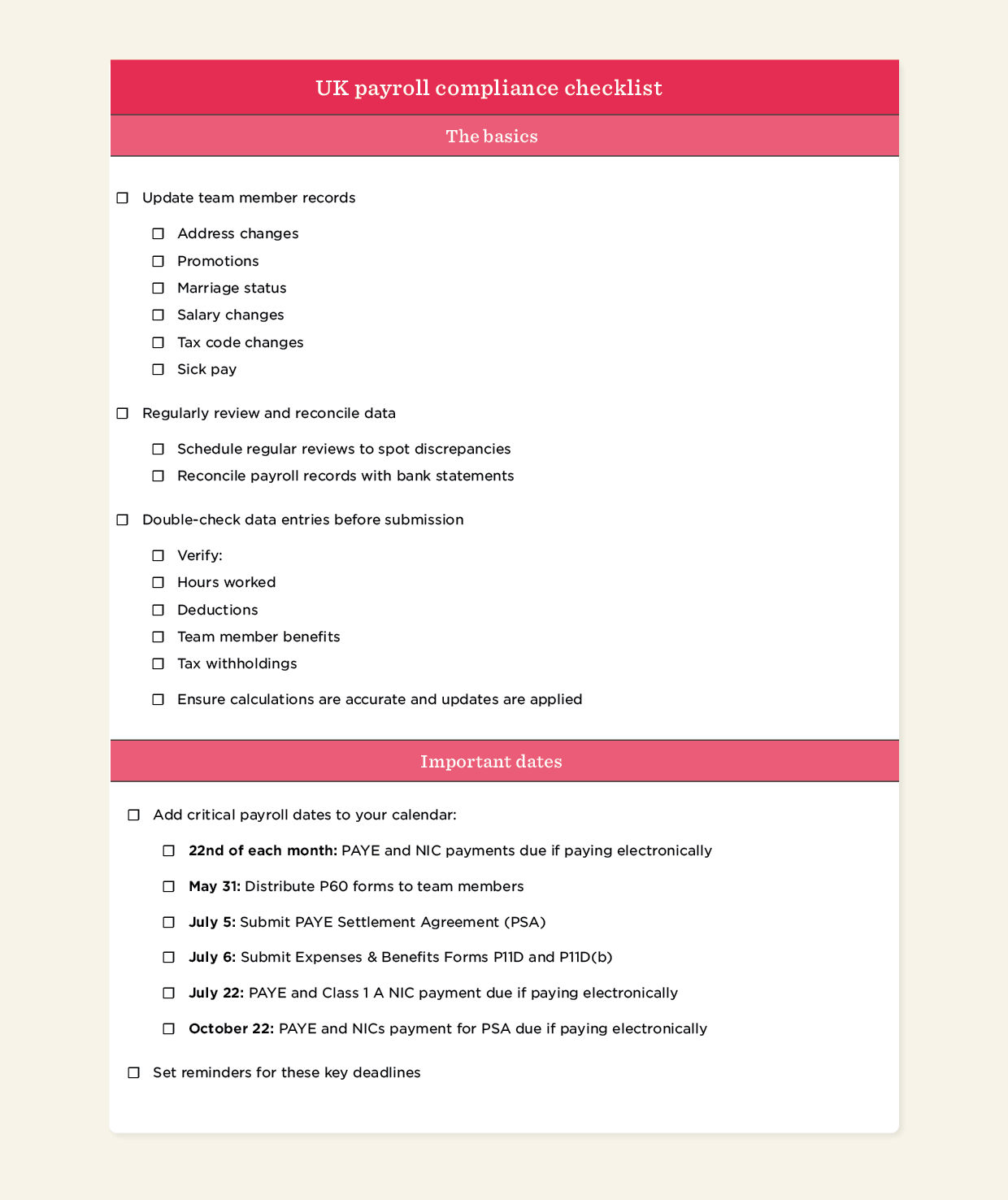

1. The basics

First off, the basic stuff.

Is all of the data you have on your team members up to date?

As obvious as this sounds, if you’re still manually processing payroll, small but costly details are easily overlooked, especially when you’re overseeing payroll for a larger team.

Since this personal data encompasses so many different factors, we’d strongly recommend updating your people’s records as and when changes occur.

Common changes to team member records include:

- Address changes

- Promotions

- Marriage status

- Salary changes

- Tax code changes

- Sick pay

Regularly review and reconcile data

To make sure your payroll data is error-free, try scheduling regular reviews to spot any discrepancies or mistakes that might land you in trouble.

You should also reconcile your payroll records with bank statements to make sure everything is accurate.

Double-check data entries

Before submitting payroll, it’s always worth double-checking your data entries—things like hours worked, deductions, team member benefits, and tax withholdings.

Make sure that all calculations are accurate and that you haven’t missed any updates or changes.

Key takeaway: Update team member records as soon as changes occur and always double-check before finalizing your payroll.

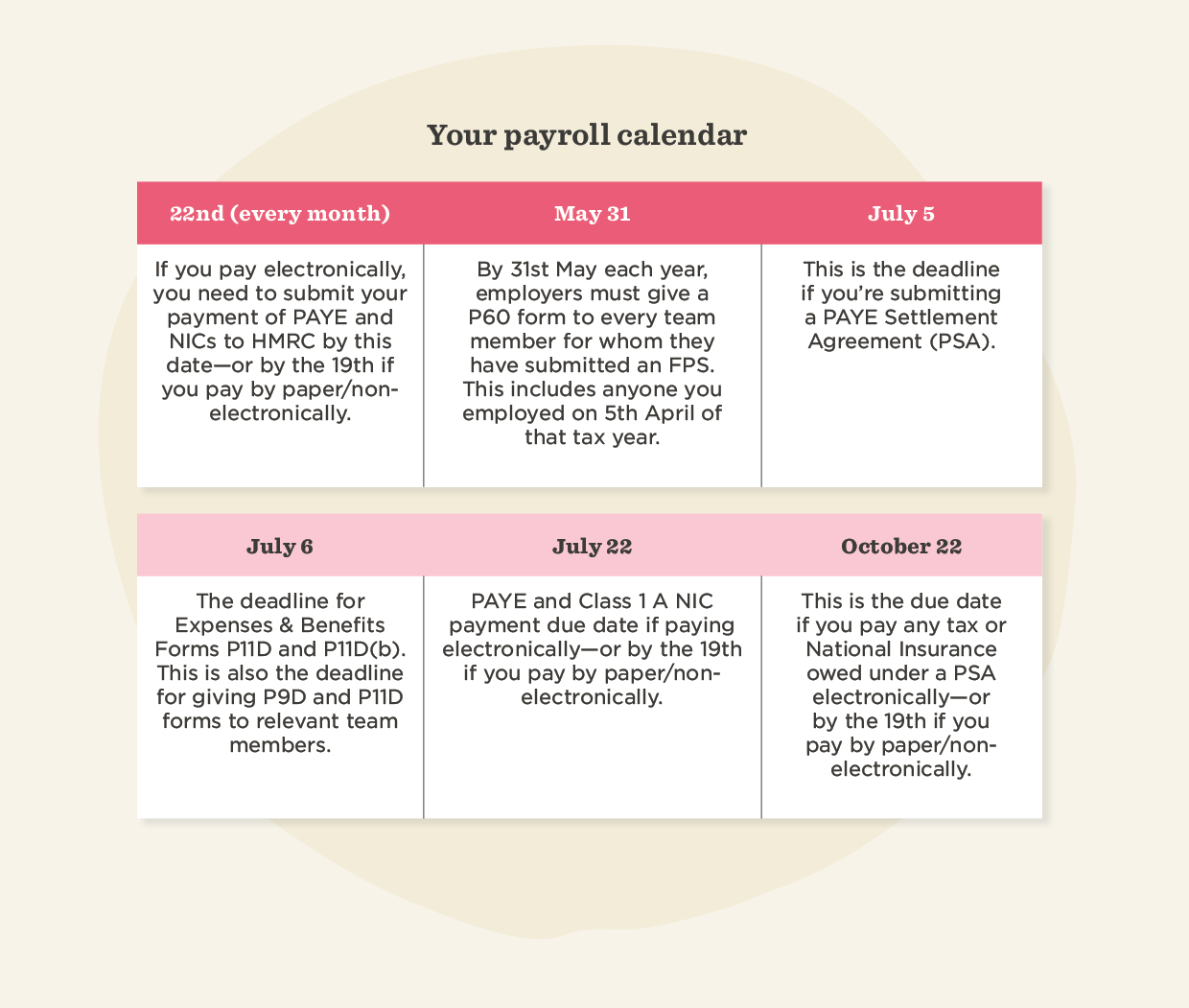

2. Create a calendar

With PAYE and RTI reporting to keep track of, managing the payroll cycle can get pretty complicated pretty quickly.

To avoid missing any deadlines, we’d recommend creating an annual calendar with all of the most important dates.

Other than payday (if you’re new to payroll, this is usually the last working day of the month), here are some of the most critical deadlines you’ll want to add to your calendar.

Key takeaway: Add paydays and HMRC deadlines to your calendar to avoid late submission penalties.

3. Stay on top of payroll legislation

It’s important to stay on top of all the latest UK payroll legislation to avoid any penalties or fines. Here’s how to keep up to date:

Check directly on the HMRC website

If you want to stay up to date with any changes in legislation, your first port of call should be the HMRC website.

Whilst perhaps not the prettiest source of information, their employer bulletins provide information on any major changes that might affect how you do payroll.

Join a community

If you’re looking for a less manual way to keep up with legislation, you can also join specialist communities and forums.

Here are a few popular UK payroll communities:

- The Chartered Institute of Payroll Professionals (CIPP) community. The CIPP offers a dedicated online community for payroll professionals, with discussion forums, blogs, events, and industry updates.

- The Payroll Centre community. The Payroll Centre provides payroll training and resources as well as a community section where you can connect with other payroll professionals.

- LinkedIn Groups. Be sure to check out groups like “UK-specific payroll” for advice and insights.

- UK Business Forums. UK Business Forums has a dedicated payroll section, where payroll professionals can interact, seek advice, and share insights.

Use payroll software

If you’re using reputable payroll software, things like legislation, tax rate changes, and reporting requirements will be automatically applied to your payroll to ensure you’re always fully compliant.

Key takeaway: Payroll legislation changes a lot. So be sure to monitor HMRC’s website and join online communities to stay up to date with payroll legislation changes if you’re not using any automation software.

4. Know your way around workplace pensions

No matter how big or small your business is, all employers have a duty to enroll eligible people into a pension scheme.

This means that you need to offer your team members the opportunity to pay into a pension which you, as an employer, will also contribute toward.

The government introduced automatic enrollment to help people save for retirement. Employers must offer a workplace pension scheme to their staff, and automatically enroll anyone who meets certain criteria.

Assess your workforce to determine who is eligible

You’ll first need to determine which team members are eligible for auto-enrollment. Assess their age, earnings, and employment status to identify who must be automatically enrolled in a workplace pension scheme.

When it comes to auto-enrollment, most people will fall into one of the following three categories:

Eligible jobholders

Team members who are between 22 and State Pension age and earn over £10,000 per year. Eligible jobholders can opt out of the pension scheme once they have been automatically enrolled. They have a one-month window in which to opt out if they want their pension contributions refunded.

Non-eligible jobholders

Team members aged between 16 and 21 or State Pension age and 74, who earn over £10,000 per year, or are between 16 and 74 and earn over £6,240 per year but under £10,000.

Entitled workers

Team members earning below £6,240 a year and are aged between 16 and 74. Entitled workers have a right to join the scheme but you don’t have to make a contribution (although most employers generally do).

Familiarize yourself with the minimum contribution levels

Qualifying earnings basis

The minimum employer pension contribution is a set percentage of a team member’s qualifying earnings. These qualifying earnings are a specific portion of an individual’s earnings (including things like their salary, wages, commission, and bonuses).

The minimum employer contribution is 3 percent of a team member’s qualifying earnings.

Total minimum contributions

In addition to the employer contribution, there is also a minimum total contribution that includes both the employer and team member contributions.

The minimum total contribution is 8 percent of a team member’s qualifying earnings, with you, the employer, contributing at least 3 percent and the team member contributing the remaining 5 percent.

*The numbers above are for banded-earnings pension schemes—other types of auto-enrolment schemes may have different minimum contribution rates.

Choose a qualifying pension scheme

When choosing a pension provider, you’ll need to pick a qualifying pension scheme that meets the requirements set by The Pensions Regulator.

Whichever scheme you go for, it needs to be registered with HMRC and provide a default investment option for team members who do not make an active choice.

Not sure where to start? Here are a few of the most popular schemes:

- National Employment Savings Trust (NEST)

- The People’s Pension

- Smart Pension

- Aviva Workplace Pension

- Royal London

- Standard Life

*These are just some of the most commonly used providers—we’d always recommend seeking professional advice when it comes to choosing a pension scheme.

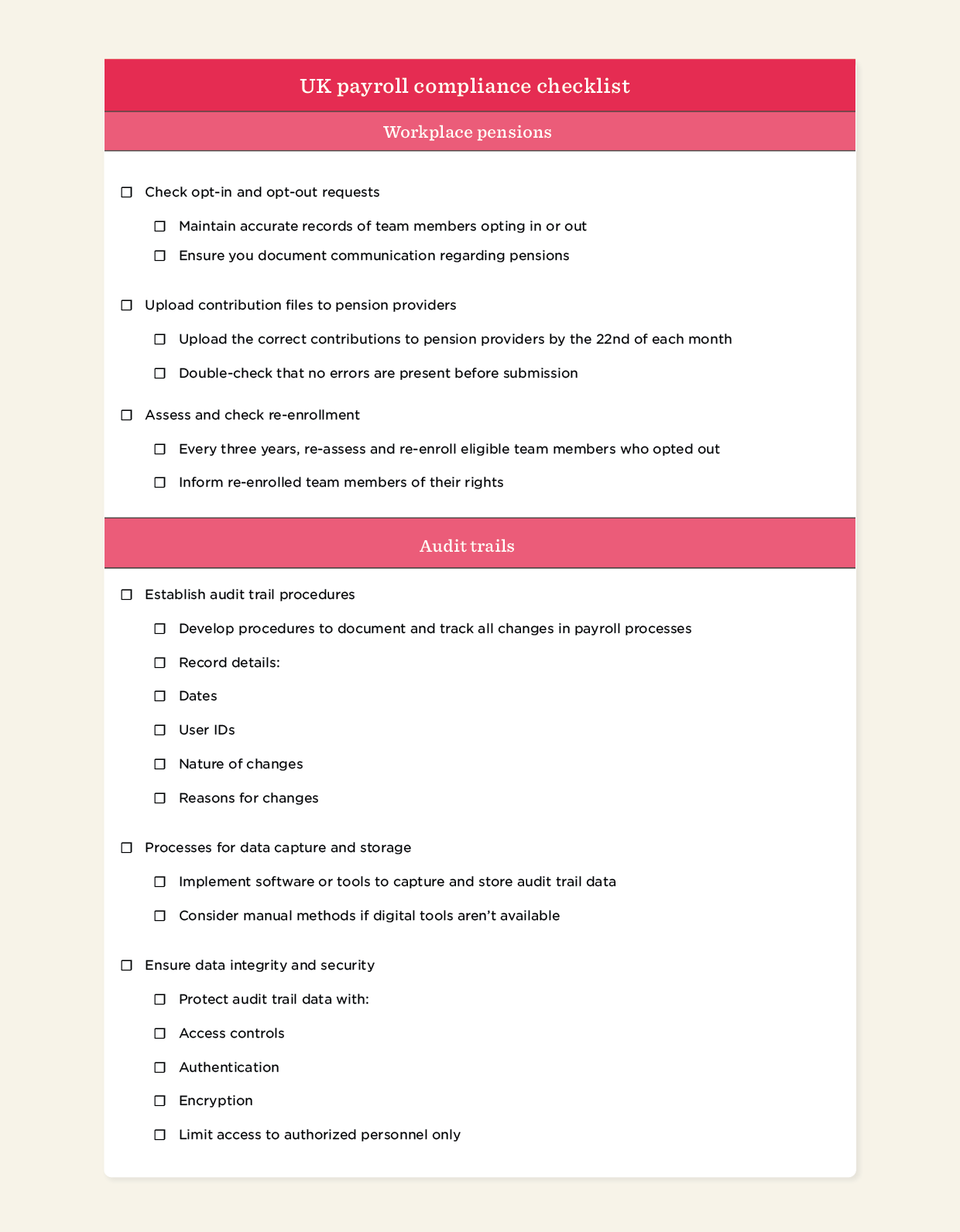

Check opt-in and opt-out requests

You’re required to keep up-to-date records of all opt-in/out requests as well as evidence of any communication regarding pensions that you may have with your team members.

Upload contribution files to pension providers

You’re also expected to calculate and deduct the correct contributions from wages and make your contributions to the pensions scheme.

Contribution file uploads must be sent over by the 22nd of each month and can’t be corrected once submitted.

Don’t forget about re-enrollment

Every three years, you’ll need to re-assess team members who previously opted out or ceased active membership. You can then re-enroll eligible team members back into the pension scheme and inform them of their rights.

Key takeaway: Make sure you enroll eligible team members in your pension scheme, keep your records/requests up to date, and be sure to submit your contribution file by the 22nd of each month.

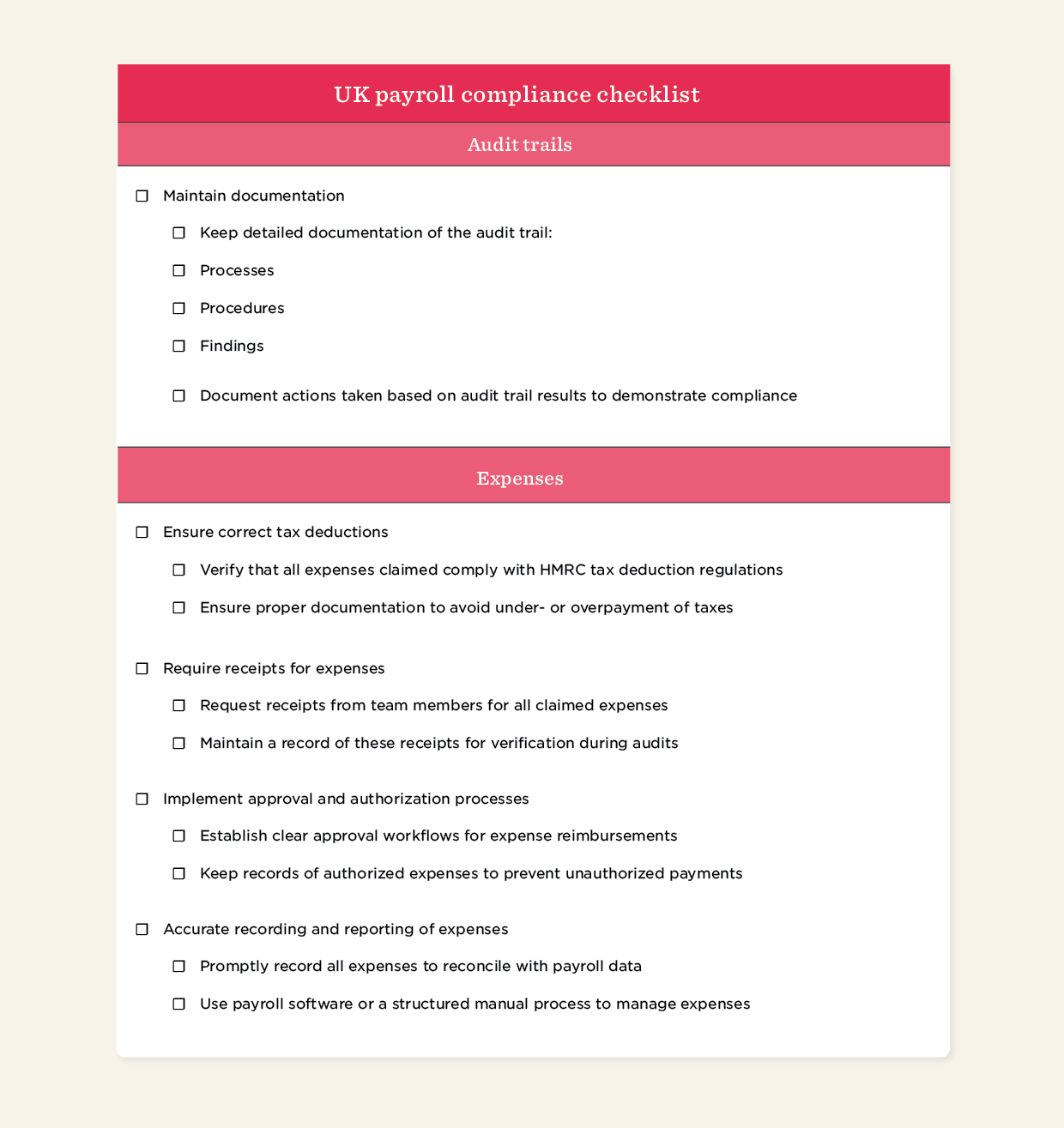

5. Make use of audit trails to minimize risk

Audit trails are essentially records of events, procedures, and operations that allow you to monitor and verify the accuracy and compliance of your processes.

If HMRC does come knocking, an audit trail will give you all the relevant documentation to prove you‘ve gathered the right personal data for team members, put them on the correct tax code, and paid them the National Minimum Wage.

Think of it as an extra layer of safety that allows you to see who changed what and when. If you do happen to fall short anywhere, you can show exactly what was done and who did it.

Note: A routine HMRC audit can happen once every five years or so, depending on the industry you’re in.

If you do happen to face an audit, you’ll want to be sure you’ve done the following:

- Established audit trail procedures. Develop clear procedures for documenting and tracking changes in your payroll processes. Are dates, user identification, the nature of changes, and the reasons for changes all explicitly recorded?

- Data capture and storage. Do you have software or tools in place to collect and store audit trail data? If not you can also use more manual methods like paper-based logs or spreadsheets.

- Ensured data integrity and security. Your audit trail data needs to be kept safe and secure. If you haven’t already, implement access controls, authentication, or encryption to protect this data from unauthorized access.

- Maintained documentation. If you are audited, be sure to keep detailed documentation of the audit trail processes, procedures, and findings. Document any actions taken based on the audit trail results. This documentation is crucial for demonstrating compliance and responding to any inquiries that might rear their head.

Key takeaway: Organize your audit trail data and practice regular reviews so that you can show exactly what changes were made if HMRC conducts an audit.

6. Double-check expenses

Business expenses can potentially cause problems with payroll compliance. So here’s what you’ll need to keep an eye on:

Are your tax deductions correct?

Expenses claimed by team members need to comply with HMRC regulations for tax deductions.

If business expenses are not properly documented or do not meet the criteria set by HMRC, this could result in your under- or overpayment of taxes, leading to issues, which, needless to say, is not good for compliance.

Make sure you keep receipts

To claim expenses, team members will generally need to provide receipts of some kind. Without these, you’ll have trouble verifying the legitimacy of expenses during audits or compliance reviews.

Have a process for approval and authorization

Expenses should be properly approved and authorized before being reimbursed.

A lack of proper approval processes can result in unauthorized or excessive expense payments, which can lead to compliance issues.

So be sure to implement a clear approval workflow and keep authorization records to keep your organization compliant.

Don’t drop the ball on expense reporting and record-keeping

Accurate recording and reporting of expenses is absolutely vital for payroll compliance.

If expenses are not promptly recorded or maintained, reconciling payroll data and ensuring compliance during audits or reviews will become challenging.

We’d strongly recommend setting up a proper process for expense management or managing it using a payroll software solution.

Key takeaway: Expenses can get messy, so make sure you have clear processes and policies in place and that all expenses are properly recorded.

<<Download our comprehensive UK payroll compliance checklist in PDF format here.>>

How HiBob handles payroll compliance

We know that keeping on top of payroll compliance requires some serious manual legwork.

That’s why we built Bob’s UK Payroll. Bob provides automation and payroll expertise to help remove human error and time-consuming admin work, so HR and payroll professionals can concentrate on the bigger picture.

With Bob, you get:

Automated compliance calculations

Bob automates payroll calculations, so you can be sure all records are accurate and compliant across wages, taxes, and deductions. We’ll adjust for all the latest tax rates, employment regulations, and statutory requirements.

Recommended For Further Reading

Real-time compliance monitoring

We’ll provide real-time compliance monitoring by flagging potential issues and errors as they occur.

Bob performs extensive validations and checks on payroll data to identify discrepancies, inconsistencies, or violations of legal requirements. So you can quickly address any potential risks.

Regulatory updates and compliance reporting

Want to take the hassle out of payroll compliance?

Our CIPP-certified payroll professionals help you with any payroll queries and keep you up to speed with any regulatory changes and updates relevant to you—whether it be the latest tax laws, employment regulations, or reporting requirements.

Bob will generate accurate compliance reports, such as RTI filings, P60s, and other statutory reports, so you never miss a deadline.